Personal Finance

How to Protect Yourself from Financial Fraud and Scams

Don’t be a victim of fraud or scam. Know how to avoid being one.

Published

3 years agoon

By

Mario

It is a fact of life that there are people out there who want to take advantage of others, and the world of finances is no exception.

From phishing scams to investment fraud, scammers are always looking for new ways to separate you from your money. But don’t worry, there are plenty of ways to protect yourself from financial fraud and scams.

In this article, we’ll look at some of the most common types of financial fraud and scams, and give you tips on keeping your finances safe.

The Numbers Don’t Lie: The Impact of Financial Fraud and Scams

Consumers reported losing $3.3 billion to fraud in 2020, with impostor schemes being the most commonly reported kind of fraud, according to the Federal Trade Commission (FTC).

The FTC also noted that, with a $1,700 median loss, Americans aged 70 and older were most likely to experience financial losses due to fraud.

Identity theft may have a serious negative effect. Over 164 million records were compromised as a result of 791 documented data breaches in 2020, according to the Identity Theft Resource Center (ITRC).

The ITRC also stated that credit card fraud and fraud involving government documents or perks were the two most frequent forms of identity theft.

These figures highlight how crucial it is to educate yourself about the different kinds of financial fraud and scams that exist and to take precautions to safeguard yourself.

By staying informed and taking steps to protect your personal information, you can reduce your risk of becoming a victim of financial fraud or scams.

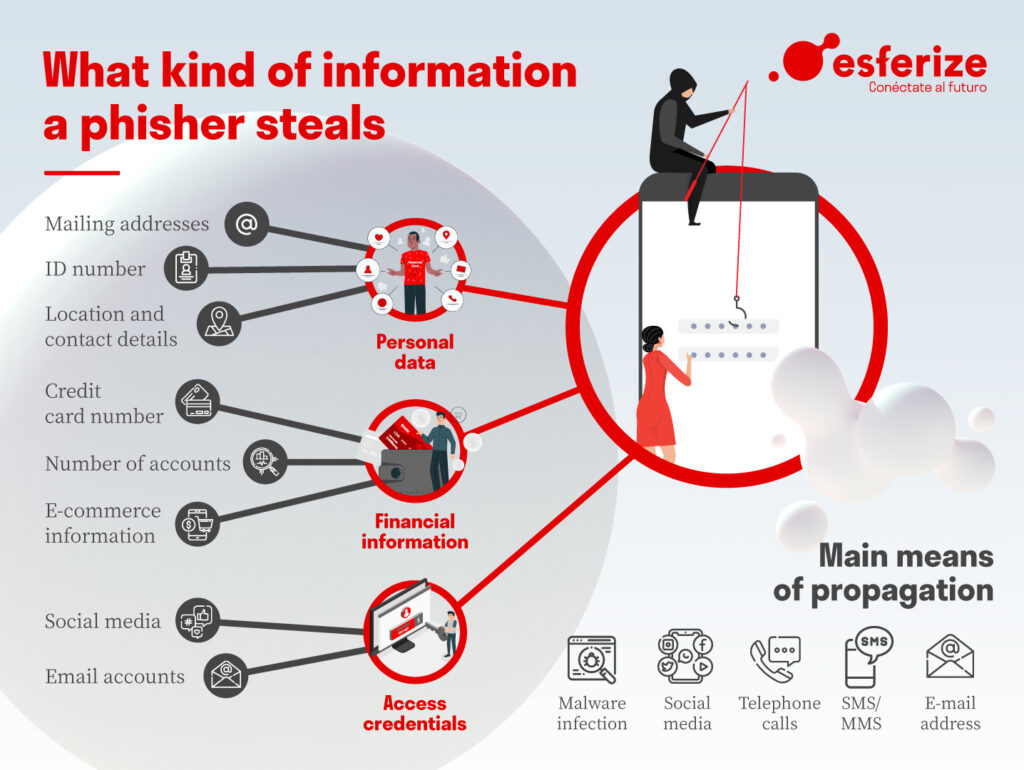

Phishing Scams

One of the most prevalent types of financial fraud is the phishing scam. These schemes involve someone pretending to be a reputable business (such as a bank or government agency) and attempting to con you out of money or personal information.

They might communicate via phone call, text message, or email. These scams are especially hazardous since they frequently have a respectable appearance and prey on people’s confidence and fear.

The best thing you can do to safeguard yourself from phishing scams is to be wary of any unwanted contact, particularly if it requests personal information or money. Never give someone you don’t know or trust your personal information or money.

Additionally, it’s crucial to keep the security of your computer and mobile device updated and be informed of the most recent phishing scams.

Investment Scams

Investment scams are another typical form of financial fraud. A person will try to persuade you to invest in a system that offers large profits with little to no risk in these con games.

The issue with these scams is that they frequently seem too good to be true, and the only individuals profiting are the con artists.

You should always be careful of anyone who offers large profits with little to no risk if you want to safeguard yourself against investing frauds. Additionally, it’s a good idea to do extensive research on any investment possibility before committing to any funds.

You can utilize a searchable database of investment professionals and firms maintained by the Securities and Exchange Commission (SEC) to determine if a person is registered and whether they have a history of complaints.

Thus, it’s important to be aware of the latest investment scams and be suspicious of any unsolicited investment offers.

Identity Theft

Another sort of financial fraud that can have major repercussions is identity theft.

This kind of fraud entails the theft of your personal data, such as your Social Security number or credit card details, which is then used to start credit accounts, make transactions, or even commit crimes in your name.

To protect yourself from identity theft, you should be careful about sharing personal information and always keep your computer and mobile device security updated.

It’s also a good idea to check your credit report regularly to make sure there are no unauthorized accounts or charges.

In Conclusion

There are many kinds of financial fraud and scams, and con artists constantly think of new ways to rob you of your money.

However, you may protect your finances by being wary of unwanted contact, doing comprehensive research on any investment proposal, and taking precautions to protect your personal information.

Always keep in mind that if an offer appears too good to be true, it generally is. If you believe you may be a scam victim, trust your instincts and never be reluctant to ask for assistance.

ALSO READ: Importance of Financial Literacy for Youth

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

What are the Best Options for Investing in the Circular Economy

-

What are the Best Strategies for Investing in Infrastructure Debt

-

Squirrel vs. Moneybox: A Comparison of Savings and Investment Apps

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important