Investing

What are the Risks and Returns of Investing in Frontier Markets ETFs

Risky Business: A guide to frontier markets ETFs.

Published

2 years agoon

Hello, fellow investment enthusiasts! It might be time to think about something a little more… exotic if you’re sick of playing it safe with the typical blue-chip stocks and bonds. That’s true, I’m referring to Frontier Markets ETFs, the investment world’s “black sheep” that present both high risk and big profit.

However, knowing what you’re getting into is crucial before going all in. So take a coffee, settle in, and let’s learn more about these fascinating, if rather risky, investment possibilities.

What are Frontier Markets ETFs?

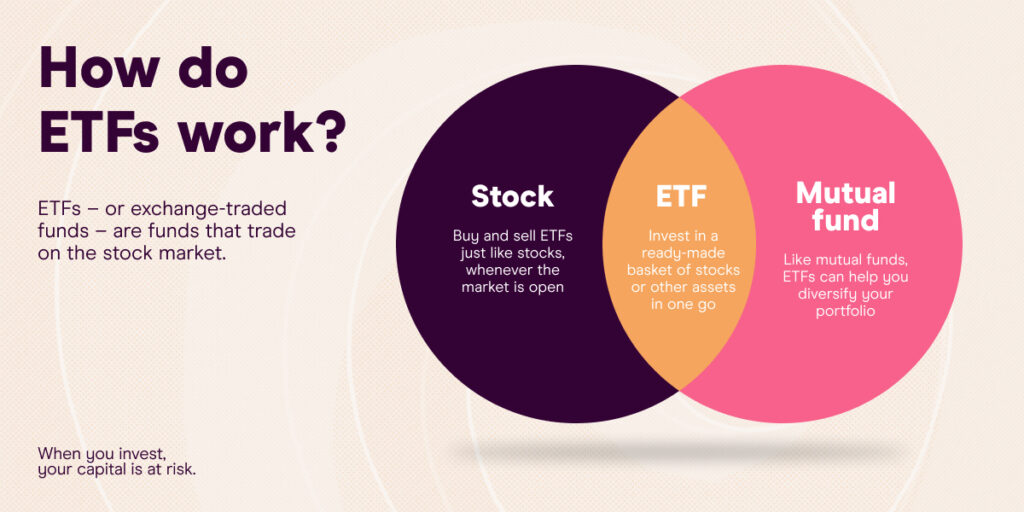

Frontier Markets ETFs are, in a nutshell, exchange-traded funds that make stock market investments in nations deemed to be “frontier markets.” These nations, like Vietnam, Nigeria, and Kenya, are distinguished by their less developed financial markets and smaller economies when compared to other emerging markets like China and India.

Why Bother with Frontier Markets?

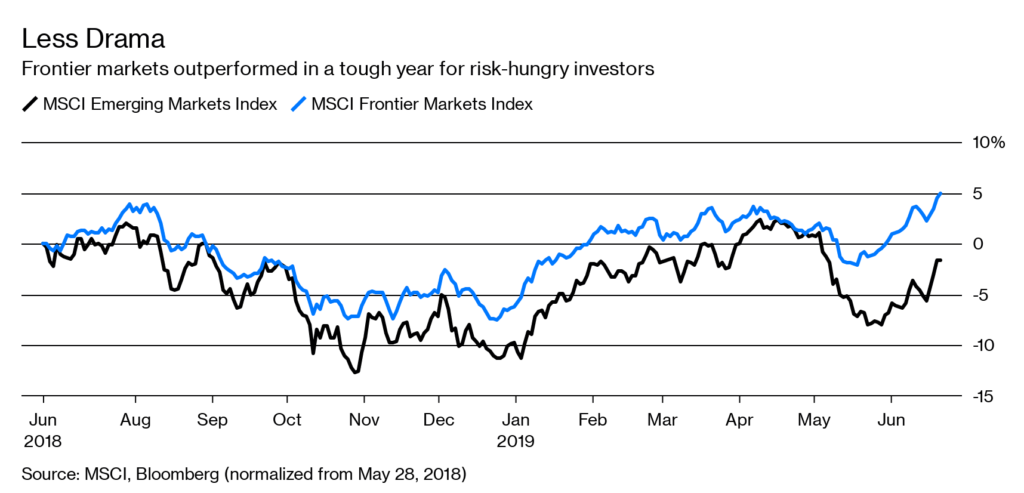

A good query! Frontier markets frequently have stronger growth potential and lower market correlation than mature economies, despite the fact that they might not have the same stability and market size. In other words, investing in these markets can give your portfolio a healthy balance of risk and reward.

Don’t rely just on my word, though. Frontier markets have outpaced emerging markets by 4% yearly over the past ten years, according to a 2019 analysis by Bank of America. That’s not bad at all!

Is There a catch?

There is always a catch, of course. Frontier markets can be famously turbulent and opaque, leaving them open to dangers in politics and the economy.

For instance, changes in exchange rates and inflation might reduce your profits, and there might be a lack of market liquidity that makes it challenging to sell your holdings when you need to.

Additionally, it could be more difficult to conduct due diligence if there is less information available on the businesses you are investing in. Not to mention the general hazards of investing in emerging markets, such as corruption, lax rule of law, and inadequate infrastructure.

Diversification is Key

Diversification is essential to minimizing risk and boosting profits when it comes to investing. Investing in frontier markets, where political and economic risks may be higher, is a good example of this.

Because of this, you should think about investing only a small amount of your portfolio in these markets and diversify your holdings over a number of different nations and industries.

You can lessen the effects of any unfavorable occurrences in one particular market or sector by distributing your investments across a number of nations and industries. This can improve the likelihood of achieving long-term gains and lower the total risk of your portfolio.

Consider how Frontier Markets ETFs would fit into your overall investment strategy if you’re contemplating investing in them. In order to maximize your returns and reduce your risks, a little diversification can go a long way.

So, should I invest in Frontier Markets ETFs?

The answer to this question is based on your unique financial objectives and level of risk tolerance, just like with any investment. Frontier Markets ETFs might not be for you if you’re hoping for quick profits.

These ETFs, however, can present a fascinating potential for diversification and growth if you’re a long-term investor with a high-risk tolerance.

Before making any decisions, make sure you do your homework, comprehend the risks, and speak with a financial expert. Always invest only what you can afford to lose, as well.

The Bottom Line

As a result, Frontier Markets ETFs are an attractive investment choice that has the potential to provide diversification and significant returns.

They are not suited for individuals who are risk-averse or those hoping for rapid riches, though, as they come with their fair share of dangers and uncertainties.

Just as with any investment, it’s critical to conduct due diligence and speak with a financial expert before deciding. Will you, therefore, make the plunge and purchase Frontier Markets ETFs? Time will only tell. But one thing is certain: it will undoubtedly be a thrilling ride!

ALSO READ: The Ultimate Guide to Saving Money on Your Next Motorcycle Purchase

This is Dean and he is a former banker with a passion for writing. He has Bachelor’s degree in Economics and an FCE English level certificate. Dean is an honest person looking for long-term partners and always giving clients more than they expect.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

What are the Best Options for Investing in the Circular Economy

-

What are the Best Strategies for Investing in Infrastructure Debt

-

Squirrel vs. Moneybox: A Comparison of Savings and Investment Apps

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important