Consumer Information

How Much Is a Vending Machine Permit in California

If you want to establish a vending machine business, get the permit first.

Published

2 years agoon

By

Yoga Adi

A vending machine business could be a lucrative way to gain profit. One could get a good income from the amount of products they can sell every day. But before you can start running the business, you’ll need a vending machine permit.

Understanding the permit might seem to be daunting for newcomers as there are regulations and rules to follow. Some states may have different requirements for this permit. Therefore, it’s essential for you to comply with them in order to legally run the business.

Among many aspects to consider when preparing the business, location does matter. You need to select a potential location where tourists are abundant and have a lot of high-traffic areas, and California perfectly fits these.

How hard is it to establish a vending machine business in California, and how much is a vending machine permit there? See the complete information below.

About Vending Machine Business

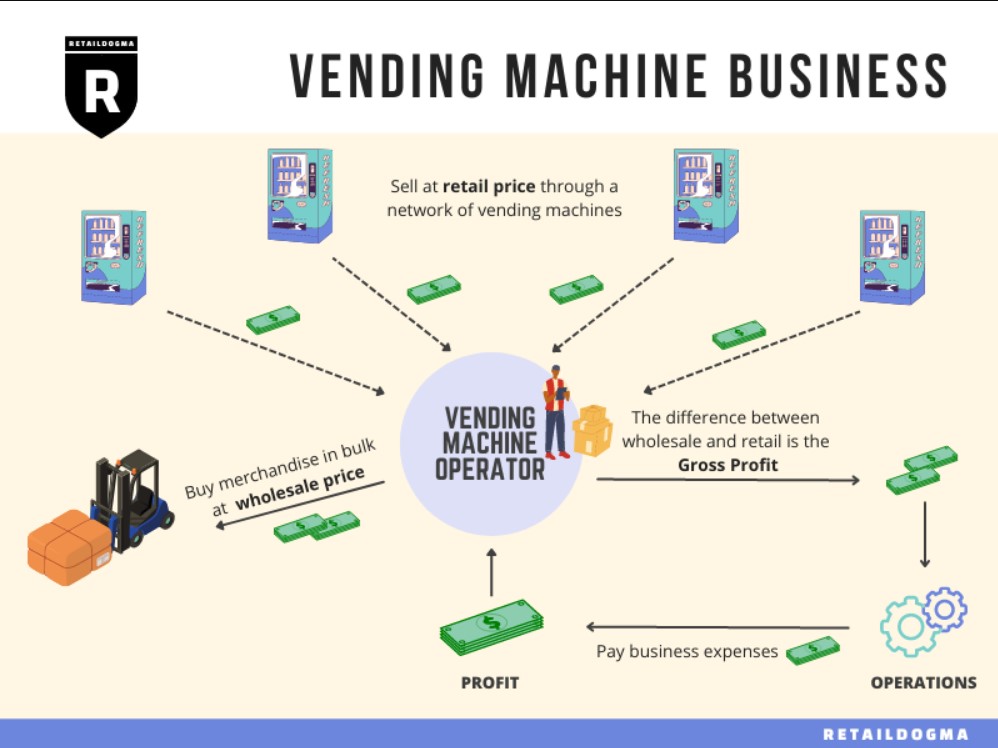

This is a type of business where the operator may gain profits from the product sales on each vending machine. As there are some machines you’d use, their placements really matter in order to sell as many goods as possible. Check the image below to see how the business works:

Vending Machine Permit in California

If you wish to make sales by using the vending machines, you’ll need a seller permit. According to CDTFA (California Department of Tax and Fee Administration), this permit is obtainable after you fulfill the necessary requirements, which we will explain in the later section.

A seller permit is a must-have document for those who want to make a profit by selling products, including through vending machines. In the case of a vending machine business, you’ll need only one seller permit, no matter how many products you’re planning to sell or how many machines you operate.

However, there’s also another one called a temporary seller’s permit, the very same permit with a limited sale duration (less than 90 days). For example, if you want to operate some vending machines at some events, this is the kind of permit you’ll need.

How to Register for A Permit

In order to get the seller’s permit, you need to go to the California Department of Tax and Fee Administration’s official website, and select “Register for a Permit”. Another method you can try is to come directly to their nearby offices or contact customer service at 1-800-400-7115.

The Exceptions

Although the seller’s permit is an important document you need to have in the business, there are some exceptions when the permit is not an absolute necessity. When you sell the foods through vending machines at a price of less than 15 cents, the permit is not a must. There’s also an exception for non-profit organizations.

Are The Sales Taxable?

We couldn’t generalize the taxes for the vending machine business as there are different taxes. If you want to sell cold drinks, hot drinks, candy, and chips through vending machines, all of these products are partially taxable. The amount applies to 33% of gross receipts of the sales.

The tax, however, doesn’t apply to vending machine foods with a price of less than 15 cents. Purified drinking water that flows through the vending machine is also free from tax. On the other hand, hot foods are fully taxable.

How Much Is The Vending Machine Permit in California?

The most interesting part is the fact that you don’t need to pay anything to get the seller permit. You can get it for free. However, you need to fulfill the long list of requirements before being eligible to receive the permit.

The California Department of Tax and Fee Administration doesn’t completely say that the process won’t be completely free as there are security deposits you need to make. These deposits are to cover the amount of unpaid taxes when the business closes.

The Requirements

In order to get the seller’s permit, you need to prepare a lot of information, such as:

- Personal details

- Date of birth

- Bank account details

- Identification number (State ID, license number, or passport)

- Details about the suppliers

- Details about the accountants

- Expected monthly sales and the taxable amount

- Previous permit (if you bought a business)

After inputting all the necessary requirements, you would eventually receive the permit and be able to start the business. As a permit holder, there are some obligations you need to remember, like making a sales and tax record, and informing CDTFA when there’s a change in your business.

Conclusion

Similar to establishing other types of business, there are some requirements you need to follow to legally run a vending machine business in California. Fortunately, getting the permit doesn’t require you to pay even a penny, except for the security deposits. So if you want to start, it’s always better to register for a permit at the CDTFA.

However, do note that the permit isn’t the same as a business license. If you need the license, contact the business license department to get it.

You may like

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important