Business

How To Invest $200 | Beginner’s Guide

You’ve got $200 to invest, and you want to make the most of it. So, where do you start?

Published

3 years agoon

In this post, we’ll teach you the basics of how to invest your money. We’ll start with the most important rule: don’t invest money you can’t afford to lose. From there, we’ll talk about different types of investments and how to choose the right one for you.

By the end of this post, you’ll know how to make the most of your $200 investment!

Why Invest & How To Invest $200?

You might be wondering why you should invest $200 when you could just as easily put it in your savings account and let it grow slowly over time. But if you want to make the most of your money, you need to think long-term.

Investing is a great way to grow your money, and with $200, you can make some smart investments that will pay off in the long run. You could put your money into stocks, which will give you the potential to make a lot of money if the stock market goes up. Or you could invest in real estate, which is a great way to build long-term wealth.

Whatever you decide to do, just be sure to do your research so that you know what you’re getting into. With a little bit of effort, you can turn $200 into a lot more money down the road.

RELATED: How To Invest $150 | Beginner’s Guide

What Can You Do With $200?

$200 is a pretty good chunk of change. You could use it to buy a new outfit, go out to dinner a few times, or even take a weekend trip. But if you’re looking to make the most of your money, there are better ways to spend it than that.

Here are a few things you could do with $200:

– Invest in stocks or mutual funds

– Start a savings account

– Buy some high-quality clothing that will last

– Purchase some home appliances or furniture

– Invest in cryptocurrency

How to Start Investing With $200

Here are a few tips on how to start investing with $200:

1. Consider using a robo-advisor. A robo-advisor is a computer program that will help you create and manage your investment portfolio. For a low fee, they will invest your money in a variety of low-cost ETFs (exchange traded funds).

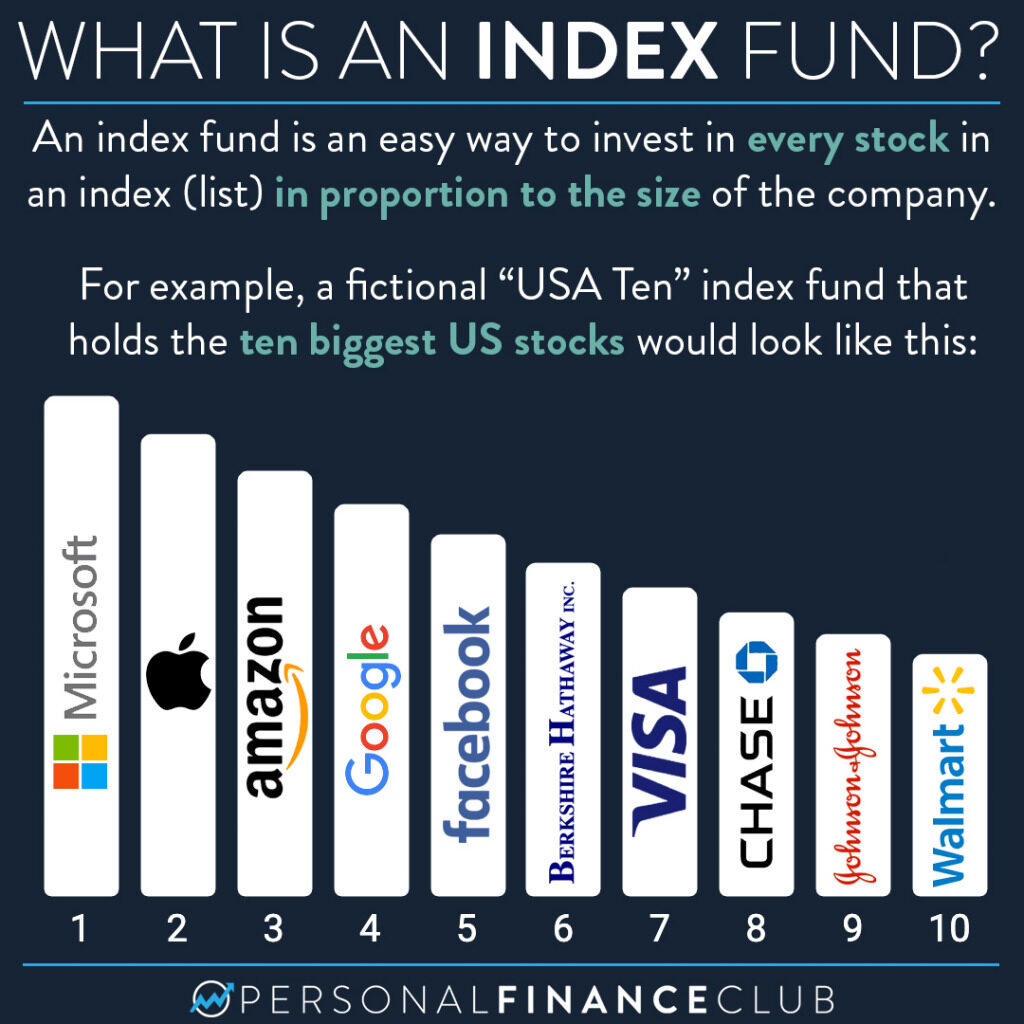

2. Invest in index funds. Index funds are a type of mutual fund that track the performance of an index, such as the S&P 500 or the Nasdaq 100. They’re popular because they provide diversification and low fees.

3. Buy stocks and bonds. If you want to be more hands-on with your investment strategy, you can buy stocks and bonds directly from a broker. Just be sure to research the companies you’re investing in, and beware of high fees.

4. You could also invest in commodities such as gold or silver. These tend to be more risky investments, but they can be very profitable if done correctly.

How to Grow Your $200 Investment

There are a number of ways to grow your money, and we’ll walk you through the most popular options.

Let’s start with stocks. Buying stocks is a great way to grow your investment over time, as long as you’re comfortable with taking on some risk. You can buy stocks through a brokerage firm or an online platform.

If you’re looking for a lower-risk investment, you might want to consider buying bonds or CD’s. Bonds are issued by the government or companies, and they usually have a lower interest rate than stocks. But they’re a safer investment because they’re less likely to lose value. CD’s are similar to bonds, but they offer a higher interest rate and they’re insured by the government.

There are also a number of investing options available for those who want to grow their money quickly. Mutual funds and ETFs are two popular choices, because they offer a broad range of investments in one package. And if you’re looking for something even more hands-off, you might want to consider investing in real estate or venture capital funds.

FAQs About Investing for Beginners

Here are some FAQs about investing for beginners that can help you make the most of your money.

Q. Can I invest $200 in stocks?

A. You can definitely invest in stocks with $200, but it’s important to do your research first. Make sure you understand the risks involved and how the stock market works before you invest.

Q. What are some good investment options for beginners?

A. There are a lot of good investment options for beginners, but some of our favorites include mutual funds, index funds, and exchange-traded funds (ETFs).

Q. How often should I check my investments?

A. Ideally, you should check your investments at least once a week. But if that’s not possible, aim to check them at least once a month.

Final Note

Now that you know how to invest $200, it’s time to put that money to work. You can start by looking for a solid mutual fund or ETF that matches your investment goals.

Or, if you’re feeling more adventurous, you could try your hand at trading stocks or picking individual stocks. Just be sure to do your research before getting started.

No matter what you choose, remember to stay calm and stay the course. Slow and steady wins the race when it comes to investing.

Ansherina is an Asian student majoring in political economy. She is an ambitious person who isn't afraid of adversity. She enjoys a wide variety of article writing. She cares deeply about her work and is competent in her field.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How Do I Request a Business Audit

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

Starting a Dog Boarding Business at Home and the Cost Included

-

Why Data Analysis is Important in Making Business Decisions

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important