Business

How To Invest $250 | Beginner’s Guide

Investing is a complex process, but if you put in a little bit of extra work and use some common sense, you should be able to make wise investments that will assist in the expansion of your business.

Published

3 years agoon

However, in order to be successful in the stock market, you need to have a solid foundational understanding of the fundamentals. This article will give you with guidance on how to invest $250 in stocks and funds, as well as an overview of certain fundamental ideas that you should be familiar with.

We will also show you how to traverse the complexity of possibilities so that you are able to make the most knowledgeable decisions possible on your investments.

Investing $250 | Complete Beginner’s Guide

What Is A Stock?

A stock is an ownership stake in a company. Stocks can be either publicly traded or privately held. A public stock is available to the general public and can be bought and sold on the stock market. A privately held stock is owned by a small group of people and can be bought and sold only through them.

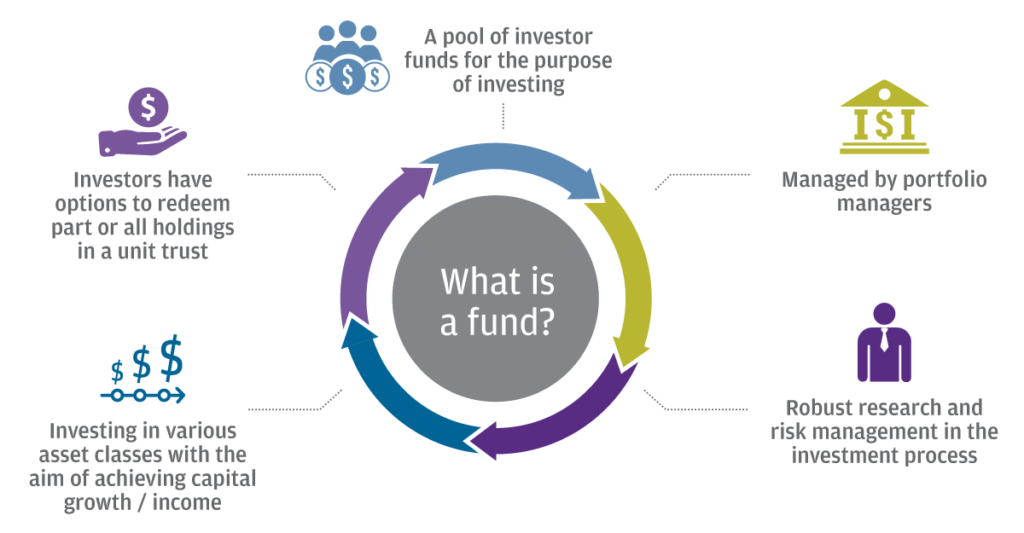

What Is A Fund?

A fund is an investment vehicle that allows you to invest in stocks and other securities. Funds are managed by professional investors and offer a variety of services, including portfolio management, investment planning, trading, and insurance. The goal of most funds is to provide you with exposure to different types of securities so that you can make better financial decisions while traveling.

RELATED: How To Invest $200 | Beginner’s Guide

How To Invest In Stocks And Funds?

To invest in stocks and funds, there are a few steps you will need to take:

- First, you should identify what type of stock or fund you would like to buy

- Next, find the right price for the stock or fund

- Finally, complete some paperwork related to buying the stock or fund and investing

How To Choose The Right Stocks & Funds

It’s important to decide what you are investing in before starting your investment journey. For example, if you are investing in stocks, it’s important to choose a good stock market to invest in. This will allow you to make a return on your investment while still wearing the clothes you choose.

In addition, you should also consider the type of stock or fund that will be best for your needs.

For example, if you want to invest in stocks that offer high returns but don’t require much capital, then a mutual fund may be a better option for you. However, if you only plan on making small investments and don’t care about high returns, then an individual stock might be a better choice.

Finally, it is important to choose the right funds for your needs- some funds offer more than others when it comes to returns and diversification.

For example, some funds offer higher yields (meaning they provide more money back for each dollar invested) while others focus more on risk management and provide less financial stability. Ultimately, these factors will determine which stocks and funds are best for you and your needs.

Get The Most Out Of Your Investment

Good financial planning can help you make smarter investment decisions.

By keeping your finances in check, you’ll be able to allocate your money more efficiently and stay within your budget. In addition, by following a budget and stock investing plan, you can follow through with your investments and grow your portfolio while saving money.

Get The Most Out Of Your Money

Making smart investment choices will also require some common sense when it comes to spending and saving. By following a regular budget and setting aside enough money for each needs, you’ll be able to save up for big goals like buying a home or starting a business.

Additionally, if you want to invest your money in stocks, be sure to do your research before making any purchases and follow advice from market experts to get the best results.

Use Financial Planning To Make Smart Investment Decisions

A good financial plan starts with having a goal in mind–say, wanting to save 10% on my income each year–and then creating an individualized plan that fits that goal. From there, it’s up to you to figure out how best to save and invest that money!

Final Note

Investing in stocks and funds can be a great way to make money, but it’s important to be organized and use financial planning to make smart investment decisions. By staying disciplined and using financial planning to make smart investment decisions, you can achieve the greatest return on your investment.

Ansherina is an Asian student majoring in political economy. She is an ambitious person who isn't afraid of adversity. She enjoys a wide variety of article writing. She cares deeply about her work and is competent in her field.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How Do I Request a Business Audit

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

Starting a Dog Boarding Business at Home and the Cost Included

-

Why Data Analysis is Important in Making Business Decisions

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important