Investing

How to Maximize Returns by Investing in Private REITs

Learn how you can enjoy maximum ROIs by making investments in private REITs.

Published

2 years agoon

Are you sick of the ups and downs of the stock market and are seeking a more reliable investing choice?

You might find the ideal solution in private real estate investment trusts (REITs).

Investing in private REITs enables you to hold a stake in a real estate portfolio without actually owning any real estate. In this article, we’ll look at how you can earn the most money by investing in private REITs.

What are Private REITs?

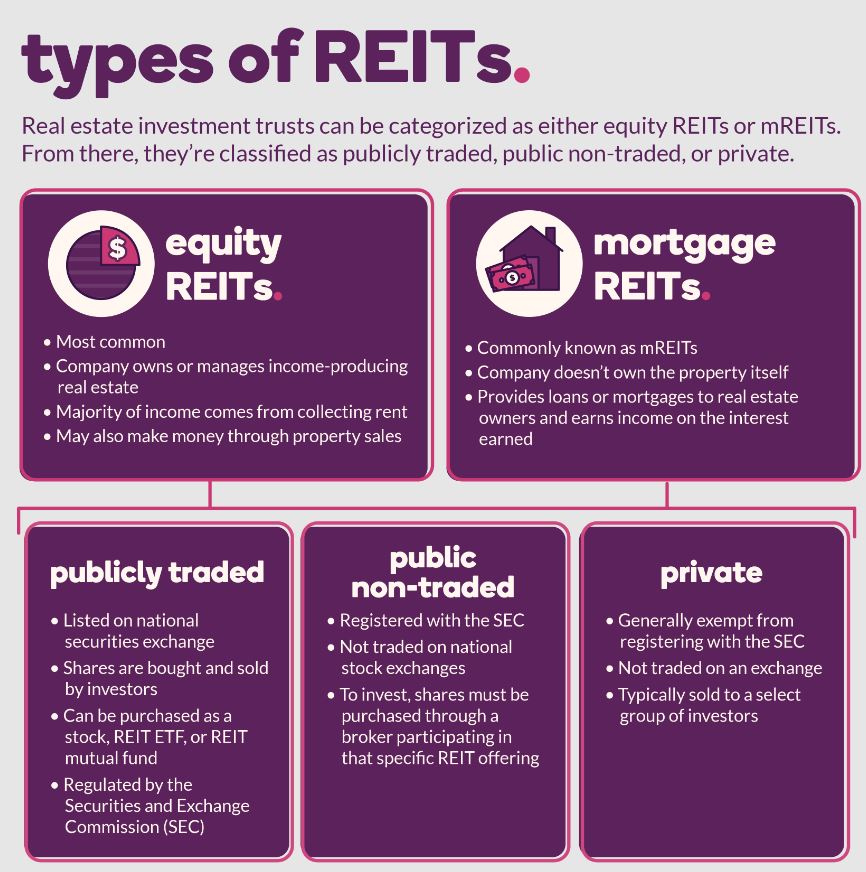

A REIT is a business that owns and manages income-producing real estate assets, including homes, offices, hotels, and shopping malls.

Private REITs are exclusively available to accredited or institutional investors since they are not obliged to register with the Securities and Exchange Commission (SEC) as opposed to publicly traded REITs that are listed on major stock exchanges and accessible to civilian investors.

Why Invest in Private REITs?

Compared to their public counterparts, private REITs have a number of benefits. For starters, private REITs can operate more freely and may produce higher returns because they are not subject to the same amount of regulatory supervision as public REITs.

Since they are not subject to the demands of short-term investors, private REITs also have more control over the timing and pricing of their investments.

The lack of liquidity, which may make it more difficult for you to sell your shares than with publicly traded REITs, is one potential drawback of investing in private REITs.

Maximizing Returns in Private REITs

So, how will you be able to maximize your returns when you decide to invest in private REITs? Here are some ideas to think about:

Do Your Due Diligence

It’s crucial to conduct your research before making an investment in a private REIT. You should look into an organization’s background, management, investment philosophy, and track record.

Be cautious of promises of large returns in the absence of a strong investment strategy. Instead, look for reliable sources of information from third-party analysts or industry journals.

Consider the Company’s Diversification Strategy

The diversification that a REIT provides is one of its main benefits.

Your exposure to any one specific property or market can be decreased by investing in a variety of properties across various locations, asset classes, and risk tolerances.

It’s a good idea to examine the company’s diversification strategy and see whether it supports your investment objectives when assessing a private REIT.

Look for a History of Reliable Performance

Look for a company with a long history of consistent performance when selecting a private REIT.

You want a REIT with a track record of producing consistent, dependable income and avoiding large losses. Be cautious of businesses that advertise excessive returns or high levels of investment risks.

Consider the Fees

Private REITs have expenses, just like any investment, and these fees can reduce your profits.

With this in mind, consider checking the company’s charge schedule when assessing a private REIT to see if it is affordable in comparison to other REITs on the market.

Management costs, purchase fees, and disposition fees are some of the typical fees you can come across.

Evaluate the Liquidity Options

Finally, it’s crucial to assess the liquidity options when thinking about a private REIT.

If you need to liquidate your investment, it may be more difficult to sell your shares in private REITs because they are not traded on public exchanges.

Limited liquidity options, such as quarterly or annual redemption programs, may be provided by some private REITs.

Conclusion

For investors seeking steady, long-term earnings, private REITs present a special opportunity.

It’s crucial to keep in mind that investing in private REITs entails risks, so you should speak with a financial counselor before making any decisions about your investments. However, private REITs might be a good investment for you if you’re prepared to do your homework.

So, why not try private REITs? They might just hold the key to unlocking your investment, you never know.

ALSO READ: Pros and Cons of Prepaid Cremation

This is Dean and he is a former banker with a passion for writing. He has Bachelor’s degree in Economics and an FCE English level certificate. Dean is an honest person looking for long-term partners and always giving clients more than they expect.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

What are the Best Options for Investing in the Circular Economy

-

What are the Best Strategies for Investing in Infrastructure Debt

-

Squirrel vs. Moneybox: A Comparison of Savings and Investment Apps

-

What are the Risks and Returns of Investing in Frontier Markets ETFs

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important