Saving

How to Do A No-Buy Month

Although seems challenging, a no-buy month is definitely doable.

Published

2 years agoon

By

Yoga Adi

The concept of no-buy month (or no buy-year for those who have higher motivations) has been a unique idea that people may adopt in their lives in personal finance. However, it slowly becomes a trend in other industries as well, especially fashion.

The reason why it gains more traction is the people who slowly realize that there are so many things they could compromise in their lives.

There are things less important that could be removed from monthly spending. By pushing down the unnecessary buying, they could save up more money while keeping the consumerism away.

However, how can we do it more effectively? Should we ban all kinds of buying in our lives? Of course, we wouldn’t go that far. There are some unwritten rules you need to know beforehand in order to make your plan more successful.

Instead of completely cutting multiple spending at once, it would be best for you to focus on one thing first, and grow from that later on. To get more detailed information, see more in the section below.

Understanding The No-Buy Month

Before we talk about what are the effective ways you can do it, we highly recommend you first understand the whole concept. Shortly, it is a financial plan that would prevent anyone from spending extra money on something outside their monthly needs, like food, bills, and other mandatory things.

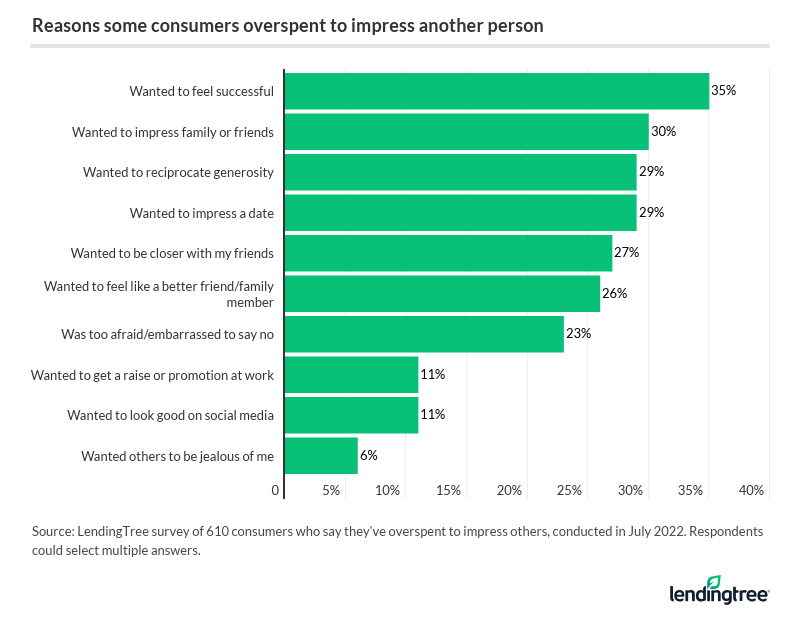

It’s an effective way to prevent or be free from overspending, a financial problem that’s common in today’s world. And there are so many reasons why people are suffering from overspending:

Most of the time, we don’t actually realize that we overspend our budget before it’s too late. Some people are even suffering from compulsive buying, something that’s definitely more alarming.

So in order to get back to the “normal” self, establishing a commitment like this may help in reconfiguring what’s important and what’s not. You may set which kind of item you will not buy for a month, and commit it within a certain time frame (in this case, a month). Although it might be hard at first, with strong determination, you will eventually surpass it.

But, of course, you may always do it on your own terms. So it would be best to prepare everything before you actually engage in a no-buy month. Most people wouldn’t even start before achieving certain things beforehand.

For example, people would do it after they complete their trip somewhere. Or, you may also start it after you buy a certain thing you want, including your tertiary needs. You may extend it in any way you like, but be sure to commit to your plan later on.

How to Do It?

Similar to other personal financial planning, a no-buy month also requires some rules you need to follow.

1. It’s Best to Keep Everything Simpler

Rather than being stressed thinking about all the enjoyable things you need to stop purchasing, it would be best for you to focus on something simple. First, know what your goal is in doing this. As not everyone has the same intention, knowing your ultimate goal may help in fulfilling the commitment better.

Second, be sure that your primary needs are fulfilled first. If you don’t have any food in your fridge, it would be impossible to even start it. So, make sure all the important needs are nicely covered beforehand.

And third, know what’s realistic for you. Sometimes, there are things that are inseparable from your life, no matter how important it is. Try not to push yourself too much because the idea of this concept is not to make anyone stressed out due to their own financial decision.

Instead, the goal is to find what truly matters and cut the rest you would consider not truly relevant. By selectively cutting the budget for certain things, you may effectively avoid overspending and be one step closer to a better financial condition.

2. Prepare Your Things

In the concept of no-buy month, people are free to decide when they want to start. So, they need to prepare some things first before actually committing to the plan. For example, you may start the plan after you fulfill things you want to achieve first, like going on a trip, buying a gift for yourself or someone, or extending it to make more savings.

Walk at your own pace, and you will feel that the concept is not about chores; it’s a wiser financial decision. By doing enough preparation, you may also be less stressed about it, knowing that all your enjoyment will be fulfilled nonetheless.

Another thing that we consider important to make the plan more successful is to prepare a list of the things you’re okay to live without. Stick to the most realistic options by creating a specific category, like an expensive dinner, hobby things, or others.

3. List Your Expenses

The very first thing to do to prepare for the upcoming commitment is to list all your regular expenses, including bills. List each of them in detail, and make sure to not miss anything. You can include things like gas, food, transportation fees, etc. Write down the expenses you consider really important or irreplaceable.

We also recommend you to make a grocery list before you hit to store to know what are the things to buy. Doing so may effectively cut the shopping time, which is effective to press down the desire to “check on” other unnecessary products. Keeping the unavoidable purchases may help a lot in saving your income.

You may need to prepare a different containing all the items of other things you shouldn’t buy during the no-buy month. When writing down the list, remember what makes you happy or relieved when you get them, and where the last time you see them.

At the end of the month, you may be surprised to find how much you could save without them. And the desire to buy them again will slowly disappear. You may consider using the best budget apps to make the job easier.

4. Clean Your Phone

Do you know what’s the biggest trigger of impulsive buying? Yes, the phone. In order to make the plan more effective, it’s better to clean the phone for all the marketplace apps, or at least deactivate the push notifications. That way, while you’re focusing on committing to the plan, you may not be affected by the external factors that will tempt you again.

Conclusion

Committing to doing something as important as this might be challenging for the first time. But when you are prepared, there will be nothing to worry about. Know your primary expenses and try to abandon the other ones you don’t really need.

When you finally complete it, you may realize that there are so many things you actually do not consider as important. And before you know it, you will already become wiser in handling your own personal finances.

ALSO READ: 7 Stages of The Financial Life Cycle

You may like

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important