Tips

How to Improve Your Chances of Getting a Loan

Published

5 years agoon

By

Mario

A personal loan is an amount of money that you want to withdraw from a bank or a financial institution to cover up some expenses or money you need for personal use.

With mortgage rates hitting an all-time low, getting a loan is becoming more attractive for the average person. On top of that, we have a less-than-optimal economic situation with the pandemic, that forced people to look for a financial solution.

When you are applying for a loan you don’t want your application to be denied by the lender. Lucky for you, there are some tips on improving your chances of getting the money you need.

Read the following article and find out more on how to boost your chances of getting accepted for a loan.

Types of Loans

Before applying, the first thing you should have in mind is the type of loan you want to get. Depending on your needs you can choose from various types of loans that will be best suited for you.

Here are some of the most basic types of loans.

- Personal loans – Mostly used for personal needs. For example holidays, weddings, buying something you need, etc.

- Mortgage loans – Used for buying a new home.

- Credit cards – Very helpful if you need a small amount of money.

- Student loans – Used for paying the education fees but only for licensed schools.

- Small business loans – If you want to open a small business with no more than 300 employees this is the loan you should choose.

- Auto loans – Used for buying a new car.

7 Tips on How to Improve Your Chances of Getting a Loan

Personal loan requirements can be different and there is no guarantee that your application would be approved. You need to fulfill some requirements in order to be eligible of getting a loan, so here are seven tips that will help you to qualify for a loan.

Make sure your credit score is in great condition

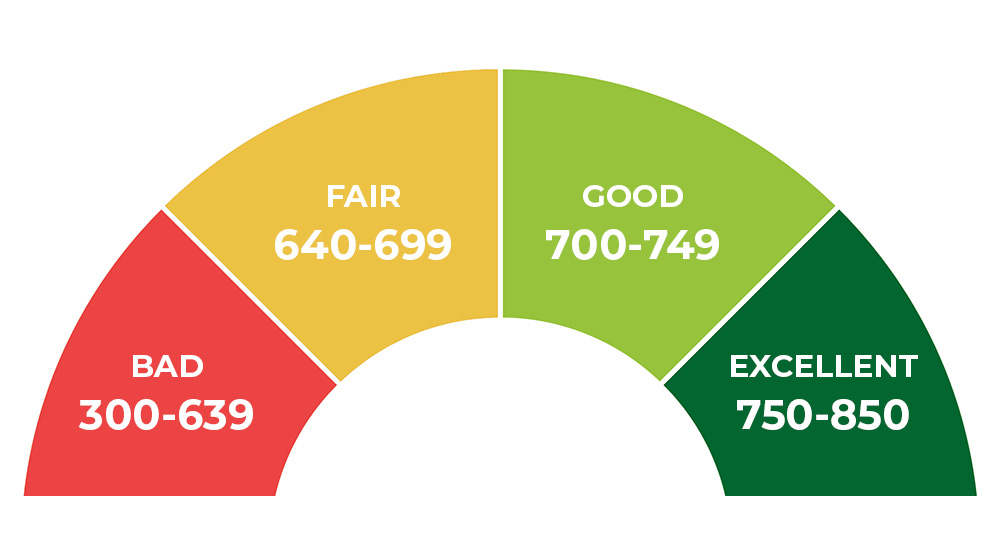

The credit score is something you should check before your loan application. In order to improve your chances of getting a loan, you should build-up, your score. You can build your score by cleaning up all your debts, so start paying your bills.

A high score is a must if you want your application to be approved. In a perfect scenario, your credit score should be above 750. So the first thing you should do is to check your credit score and start to build it up.

Don’t ask for too much money

Always be careful about the amount of money you ask for. Have in mind that you still have other costs. Before applying calculate how much money do you really need? Smaller loans are easier to be approved and also are less risky.

Have a steady job or a steady income

Your income will play a significant role in the approval process. Lenders have to sure that you have enough money to return the loan but also they want to be sure that you have a regular job. It will be a big minus if the lenders see that you constantly changing jobs. So try to have a regular job in the last couple of months before you decide to apply for a loan.

Be sure to pay on time

Even if you miss one payment it can cause you trouble and your application can be denied. Make sure that you pay every single bill on time in order to boost your chances of getting the loan you need.

Get a cosigner

If you have a low score and low income you should consider getting a cosigner. Usually, the cosigner needs to be someone with a higher credit score and high income. This kind of loan is easier for approval by the lenders because they are less risky. This way they can collect the money from two people.

The problem is that this represents a big risk for the cosigner just because if you can’t pay the debt the cosigner will have to. So before asking for a cosigner you need to be sure that you can pay the loan on your own otherwise you will ruin their credit score and put them in dept.

Apply for a short-term loan

Short-term loans are less risky for the lenders because you will pay off the loan quickly, which means there are small chances that something could go wrong for example losing your job and be unable to pay your loan. Another plus is that the lender will get his money in just a short period of time.

An advantage for you when applying for a short-term loan is that they are easier to qualify for. Also, short-term loans are less expensive because you pay interest for a short period of time. So choose wisely before applying.

Always choose the lender that is most suited for your needs

It will be wise for you to do research and compare loans before you choose the lender. There are different minimum requirements for every lender. Some lenders are only financing the most qualified applicants while others have more understanding and can lend you money even if your credit score isn’t perfect.

But don’t rush. Always make sure to double-check the lender history, reviews on their websites, etc. Keep an eye for scams. So if an offer is too good to be true then it probably is and you should probably search for another lender.

Summary

Today we showed you a couple of tips on how to improve your chances of getting a loan. Start working on your personal loan requirements if you want your lender to approve your application. By following these steps, you’ll definitely increase your chances of getting the money you need from any bank.

You may like

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important