Investing

How to Invest in Alternative Assets Such as Wine, Art, and Collectibles

Collectibles and fine arts appreciate in value over time!

Published

3 years agoon

By

Mario

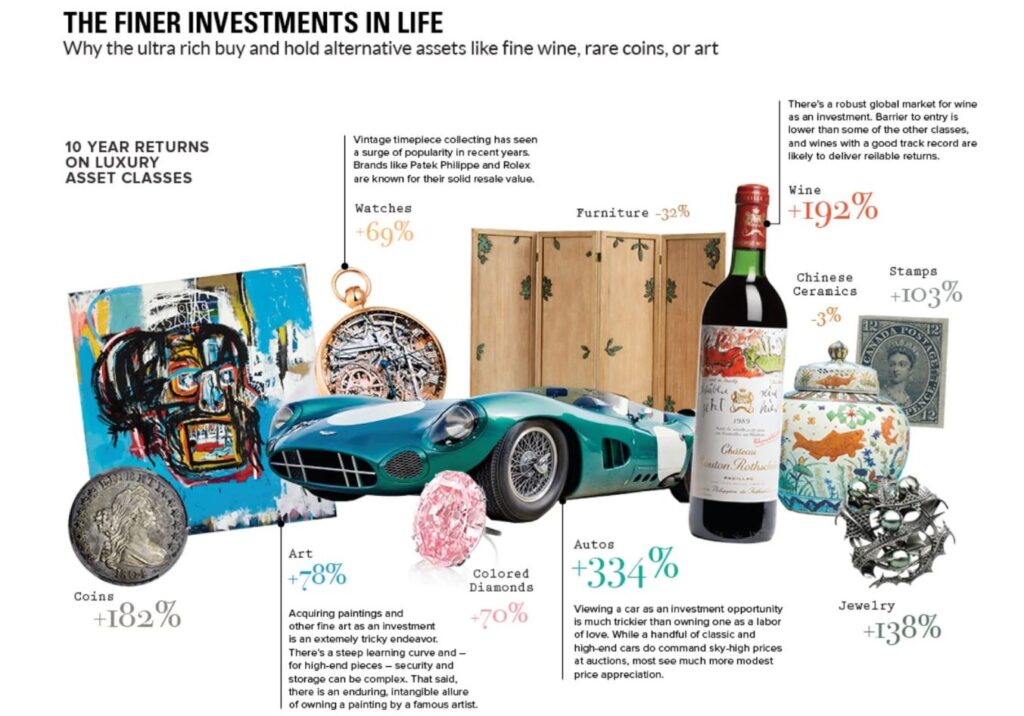

It’s no secret that traditional investments like stocks and bonds can be a bit, well, boring. However, there is a vast world of alternative assets that can bring excitement and diversification to your financial portfolio.

These unorthodox investments, which range from rare bottles of wine to one-of-a-kind works of art, have the ability to not only improve your net worth but also add a touch of elegance to your portfolio.

But how do you invest in them? What are their advantages? Let’s find out!

The Benefits of Building a Wine Collection

Wine is best enjoyed with food, but it can also be a good investment.

The value of rare bottles rises in tandem with the demand for quality wine. But how do you begin investing in wine?

It’s as simple as that: do your research, choose a reputable vendor, and keep your bottles in a temperature-controlled location.

The secret to success in wine investing is to buy wisely and well. Concentrate on collecting wine from prominent vineyards and locations, and seek out bottles with a demonstrated track record of gaining value over time.

A wine collection may be a profitable alternative asset that not only profits but also adds delight to your investment portfolio with a little bit of patience and a lot of information.

Why Adding Art to Your Portfolio is a Masterpiece

Investing in art might be a wise decision for those who are more aesthetically minded.

After all, the art world offers a diverse spectrum of investment prospects, from current artists to old masters.

The secret to success in investing in art, as with wine, is to do your research and buy pieces from recognized and in-demand artists.

But what makes art such an excellent investment?

To begin with, it is a limited resource – there is only so much of it in the world, and demand frequently surpasses supply.

Furthermore, particular art styles and periods have a historical record of gaining value over time, making art a unique alternative asset with the potential for significant returns.

Adding Some Fun to Your Portfolio

Collectibles may be just the thing for people wishing to have some fun with their investments. The world of collectibles is large and interesting, ranging from rare stamps and coins to vintage cars and comic novels.

As with wine and art, the key to success in collecting is to educate yourself on what’s in demand and buy from reliable sources.

Collectibles provide investors with a unique opportunity to not only improve their net worth but also engage in their own passions.

Whether you’re a sports fan, a history buff, or someone who simply appreciates the finer things in life, there’s a collectible out there for you.

How to Invest in Wine, Art, and Collectibles

When it comes to investing in alternative assets such as ancient wine and art, you have various possibilities.

Auction houses like Christie’s and Sotheby’s are one of the most popular and accessible ways to invest in these assets. These recognized institutions have professional staff who can help you select the proper investment and guide you through the purchasing and selling process.

Another alternative is to invest in wine or art funds which pool funds from different investors to buy and manage a portfolio of these assets.

You can even invest in specific bottles of wine or art pieces by working with a reputable private dealer or collector.

To reduce the dangers associated with alternative investments, regardless of the strategy you choose, it is critical to conduct research and only purchase from reliable sources.

The Pros and Cons of Investing in High-End Assets

Investments in high-end assets such as jewelry, real estate, and yachts can be profitable for those wishing to add some luxury to their portfolio.

However, it is crucial to remember that these investments have a higher amount of risk than regular investments.

At the same time, investments in luxury assets have the potential for huge profits as well as a degree of prestige and status that other investments just can’t match.

But before you make any luxury investments, you have to conduct a thorough study and carefully analyze the potential risks and rewards.

The Risks and Rewards of Alternative Investments

Investing in antique wine and art carries risks, just like any other investment. A range of factors, such as changes in taste and market trends, can impact the value of these assets.

To summarize, the world of alternative assets is fascinating, with a variety of investment options for those wishing to diversify their portfolios.

There’s something for everyone, be it wine, art, or just about any collectible. So, why not add some sophistication and excitement to your finances right now?

ALSO READ: What Are the Benefits of Investing in Precious Metals Like Platinum

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

What are the Best Options for Investing in the Circular Economy

-

What are the Best Strategies for Investing in Infrastructure Debt

-

Squirrel vs. Moneybox: A Comparison of Savings and Investment Apps

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important