Investing

Best Investment Strategies to Beat Inflation in 2021

Published

4 years agoon

By

Mario

The most familiar word in the economy is certainly inflation. Inflation has been a problem for countries for over 50 years. Bankers and economists are always trying to keep inflation under control. On the other hand, politicians use inflation to win elections. They make promises to fight and eliminate inflation.

So in this article, we will go deeper into inflation and we will show you what inflation is and why it is very important. Also, you will learn about the best inflation strategies in your fight against inflation.

What is Inflation and how does it affect your savings?

Inflation happens when the price of goods and services increases in a certain period of time. You need to make difference between just a regular price increase and inflation because there is a significant difference.

Inflation doesn’t come up at once and when the price of some goods and services go up. For example, if you go to your local store and buy eggs for $3 dollars and then the next week the same eggs are $5. This isn’t an example of inflation, it is just a fluctuation in prices for particular goods in the market.

If you see it from an economics perspective, inflation is when you see the bigger picture. So if we have an increase in the prices for many different products like gas, milk, college costs, and many different other goods and services.

Some economists say that a little bit of inflation can be a good thing because the economy can slowly increase the prices and companies can increase the wages.

High inflation means less spending power. This means you should find strategies to invest your money because your money will start losing value and you will lose purchasing power. Usually, an equity investment is a good way to save your money from inflation.

Although, when there is high inflation is seems like it is wrong to save some money, it can be wise to build up an emergency fund just in case.

What Do Successful People Invest In to Beat Inflation?

Warren Buffett is a legendary investor who is now 90 years old. He has been reading about inflation for a long period of time. So here are some investment strategies that beat inflation from Warren Buffett and how to make your money work for you.

- Invest money only in good businesses that have low capital needs

- Search for companies that can raise prices in a period of high inflation

- Take a closer look at Treasury Inflation-Protected Securities (TIPS) – investment endorsed by Warren

- Invest in your talents and try to be the best at what you do

- Stay away from traditional bonds

- Track your expenses with some app to know how much you are spending

- Invest in stocks or real estate.

Top 5 investing strategies according to Donald Trump:

- Always push yourself until you reach your goal. Set your mind to a strategy for what you need.

- Invest in stocks, bonds, and gold, but be prepared for the worst outcome

- Plan your spending, don’t spend more than you need to.

- Learn more about equity and bond markets

- Get the best deals possible when investing in real estate

Tips on how to profit from inflation by Robert Kiyosaki:

- Invest in commodities and energy products

- Don’t save money

- Buy real estate

- Spend money in buying precious metals

Types of investments that can beat Inflation

Here is the best type of investment strategies that beat inflation in 2021:

High-yield saving accounts

Pros: Your money is insured by the government, so basically this means you can never lose your money.

Cons: Your money can lose purchasing power.

Saving Bonds

Pros: There is a fixed rate and plus inflation rate you earn for your money.

Cons: Small return and also your money will lose purchasing power.

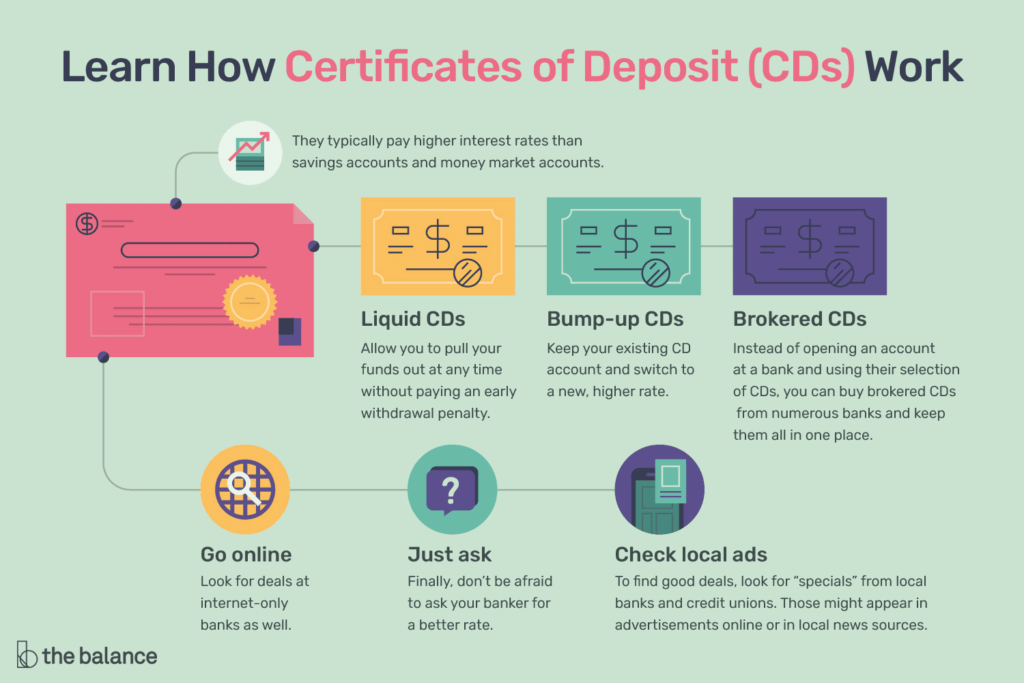

Certificates of deposit

Pros: The bank will pay you a set rate of interest after the end of the term decides.

Cons: If you withdraw your money early from the decided date you will lose the interest you earned.

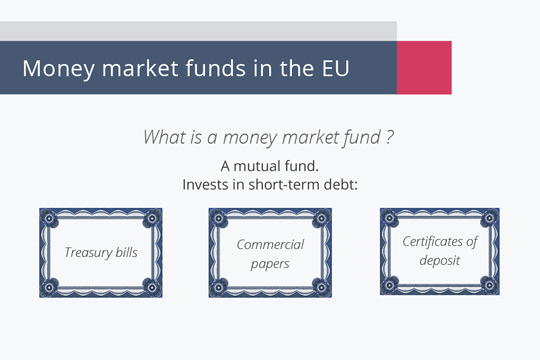

Money market fund

Pros: You can get your money every time you want

Cons: Money market funds are less safe than High-yield saving accounts.

Corporate bonds

Pros: Buying quality bonds from large companies can earn you high interest rates.

Cons: Investing in corporate bonds can be a little bit risky if the company fail to make their promises.

Dividend-paying stocks

Pros: Stocks that pay out dividends are less risky and are considered safe.

Cons: The risk of a company going bankrupt.

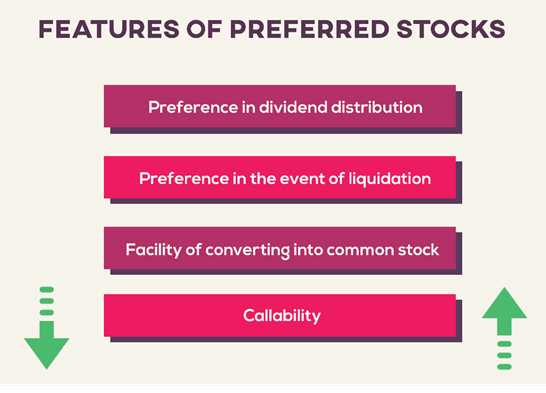

Preferred stocks

Pros: With preferred stocks, you will get a regular cash payout.

Cons: They are riskier than bonds.

Money market accounts

Pros: High interest rates.

Cons: The only risk with money market accounts is if the inflation rate is higher than the interest rate, so basically this means you will start losing money.

Fixed annuities

Pros: It is a great way to earn a fixed amount of money.

Cons: The contracts for fixed annuities are tricky and you must read them carefully.

Conclusion

Inflation is when your money starts to lose value. This can happen if the prices of goods and services increase dramatically or because the money supply has surged. It is pretty devastating happening for consumers and investors, so you need to be ready if there is high inflation and to prepare a strategy.

So, if you have concerns about inflation, then you should consider taking notes from some of the most successful people and how they cope with inflation. We hope that with this article we helped you to learn more about inflation and which inflation strategies to use in order to save your money.

You may like

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important