Investing

How Much Money Can You Make With Dividends?

Published

4 years agoon

By

Mario

Dividend investing is one of the most profitable long-term investment strategies that can help you earn passive income without lifting a finger.

That’s why investors choose dividend investing as their primary investing strategy, and as a tool to achieve their long-term financial goals.

But in order to understand the concept of dividend investing and how much money can you make with dividends, we have to dig a bit deeper.

What is Dividend Investing?

Dividend investing is a strategy that gives investors two sources of potential profit by investing in stocks. As a dividend investor, you can earn money when the stock price goes up, and from regular dividend payments.

Some companies choose to pay out dividends to their investors as a form of appreciation when the company makes a profit. The best thing about dividends is that you will be paid, regardless of what the stock price is.

So, you’ll put your money in stocks and earn a yearly dividend income, which sounds like a pretty sweet deal.

But hold your horses. There are some things you should consider before starting with dividend investing.

Avarage Dividend Yield

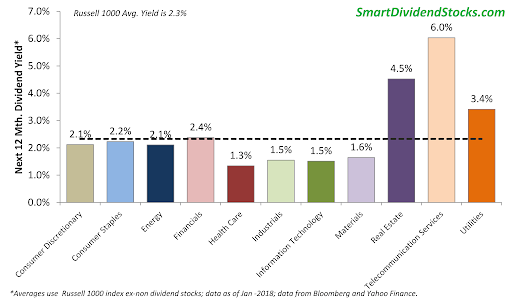

A dividend yield is a financial ratio that symbolizes the percentage of a company’s share price that will be paid out in dividends for the shareholders.

Basically, the higher the dividend yield, the more money you’ll receive as passive income.

The average dividend yield depends on the sector that the company is in, but overall, they offer similar percentages.

- The avarage dividend yield for consumer goods sector is around 2.5%

- The avarage dividend yield for the tech industry is around 3.2%

- On avarage, companies in the financial sector have the highest avarage dividend yield of 4.17%

Of course, all of this depends on which companies you choose to invest in.

Pro tip: Always make sure to go for an average dividend yield, just because a higher percentage is considered a bigger risk.

How Much You Need to Invest to Live Off Dividends?

It is time to talk numbers and find out whether or not the dividend investing strategy pays off.

Considering that the annual yield on dividend-paying stocks is not that big, you’ll need a lot of money invested to live off dividends.

The basic formula for determining how much money you need to invest is:

Annual Income You Want / Dividend Yield = Amount You Need to Invest

So, if you want to earn $1,000 in dividend income annually, you have to invest:

- $30,303 in Coca Cola (Yield 3.30%)

- $22,026 in Verizon (Yield 4.54%)

- $18,692 in IBM (Yield 5.35%)

- $13,908 in AT&T (Yield 7.19%)

Most investors choose to diversify their portfolios in different industries, which brings the average dividend yield to 4% annually.

But, how much money do you need to invest in order to live off dividends?

Well, the first thing you should determine is the amount of money you’d be happy with per year. For example, a $40,000-$50,000 annual income is enough for you to live anywhere in the world.

For example, if we take $40,000 per annum and divide that by the average dividend yield of 4% we $1,000,000.

Basically, you’ll need more than a million in order to live off dividends.

Don’t let the huge amount of money discourage you from your goals. Dividend stock investing is a long-term strategy that can be built over the course of 20-30 years with smaller investments.

For example:

If you start your dividend stock portfolio by investing $5,000 and contribute $1,000 every single month for the next 25 years, with a dividend return of average 4% and an average growth rate of your stock portfolio of 7%.

In 25 years, you will be worth $1.3 million with an annual dividend income of $52,513, or a 330% increase on your investment.

How much money can you make with dividends? – Well, you can become a millionaire, but it isn’t a get-rich-quick investment.

Advantages and Disadvantages of Dividend Stocks

Even though dividend investing is a promising strategy, you still need to consider whether or not it is a good option for you. Especially, with so many investment options up for grabs like Cryptocurrencies, Real Estate, or regular Stocks.

Check out this article if you want to learn more about Crypto Investing.

Advantages of Dividend Stocks

Advantages of Dividend Stocks

- Passive Income Stream

The biggest advantage in dividend stocks is the passive income stream that is paid to shareholders. Dividends are paid no matter if the stock price is going up or down in value, which means that you don’t have to worry about its performance. There are some rare cases where companies couldn’t pay out dividends, but that is why you need to diversify your portfolio.

On top of that, receiving cash income opens many opportunities. You can iter spent it, save it or reinvest it in your stock portfolio. - Solid Investment Returns

Since most of the companies that pay out dividends are big corporations, chances are that the stock price will go up in value. This means that you’ll get an additional return on investment.

With that said, you have to understand that dividend-paying stocks have a smaller chance of growing in value compared to growth stocks that can go up more than 100%.

In other words, dividend stocks are more stable and on average investors can expect a growth rate of around 7% annually. - Compounding Returns

Dividend investors will get the chance to reinvest their cash dividend income to buy more dividend stocks. This is a really powerful tool that is best for building wealth over the long term.

- Favorable Tax Treatment

If we examine the past couple of years, we can see that dividends have always received a favorable tax treatment, compared to taxes on a regular income.

Even though laws can always be changed, it is safe to say that dividend income will always have lower taxes.

On the negative side, dividend income is taxed twice. First, they are taxed when the company decides to pay shareholders. The second taxation comes when investors receive their dividends.

Disadvantages of Dividend Stocks

- Sector Concentration

One of the issues with dividend stocks is that there isn’t a good diversification model that will lower your risk just because most companies are clustered in certain industries.

That’s why it is really important for investors to carefully choose which stocks to buy and build a diversified portfolio as possible. That way, if one industry experiences a crash, your entire portfolio won’t be affected.

- Policy Changes

You have to understand that the dividend policy is in the company’s hands, and they can always change the rules. With that said, some of the most successful companies have strict dividend policies they are obligated to follow, and they also increase the dividend over time.

- Lower Growth Rate

As history suggests, dividend stocks have a slower growth rate than growth stocks. Most companies in the dividend stock sector have already reached their maximum potential, and cannot experience a huge rise in profit. That’s why dividend stocks have a slower growth rate.

Now that you know how much money can you make with dividends, it is time to do your homework and find the best dividend stocks to invest in.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

What are the Best Options for Investing in the Circular Economy

-

What are the Best Strategies for Investing in Infrastructure Debt

-

Squirrel vs. Moneybox: A Comparison of Savings and Investment Apps

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important