Investing

How to Invest In Alternative Assets Like Vintage Cars And Rare Books

Investing in Alternative Assets: A guide to vintage cars and rare books.

Published

2 years agoon

It may be time to extend your views and look at other investments if you’re sick with the ups and downs of the stock market. While stocks and bonds are typically the go-to investments for the ordinary investor, those who are willing to explore beyond the box will find a whole universe of alternatives.

In this post, we’ll explore the worlds of vintage automobiles and rare books, two exceptional alternative investments that can definitely spice up your portfolio.

Vintage Cars – A Timeless Investment

They don’t make ’em like they used to. Have you ever heard that expression? With vintage autos, it is unquestionably the case. These cars aren’t only a throwback to the past; they’re also a wise investment that will likely increase in value over time.

So why buy an antique car? To begin with, they are a physical asset that you can touch, observe, and (with any luck) even drive. You can feel satisfied knowing that your investment is tangible rather than simply a set of numbers on a screen thanks to this.

However, it goes beyond the sentimental aspect. Because there are so few vintage automobiles left in the world, they are also a scarce resource. Because of the scarcity, demand may increase, which raises the asset’s value.

So how can you get started investing in vintage cars? You should first conduct research. It’s critical to become knowledgeable about the market and recognize the popular makes and models of vehicles.

You can accomplish this through engaging with other auto fans, going to auto exhibitions, or reading auto periodicals.

It’s time to start looking for your new investment once you’ve done your study. The following things should be considered when looking for a vintage car:

- Condition: An automobile in good condition that has had regular maintenance will often be valued more than one that has.

- Rarity: A car’s value is likely to increase with its rarity.

- History: Vehicles having a distinguished past, such as those that have won races or belonged to well-known individuals, might fetch a higher price.

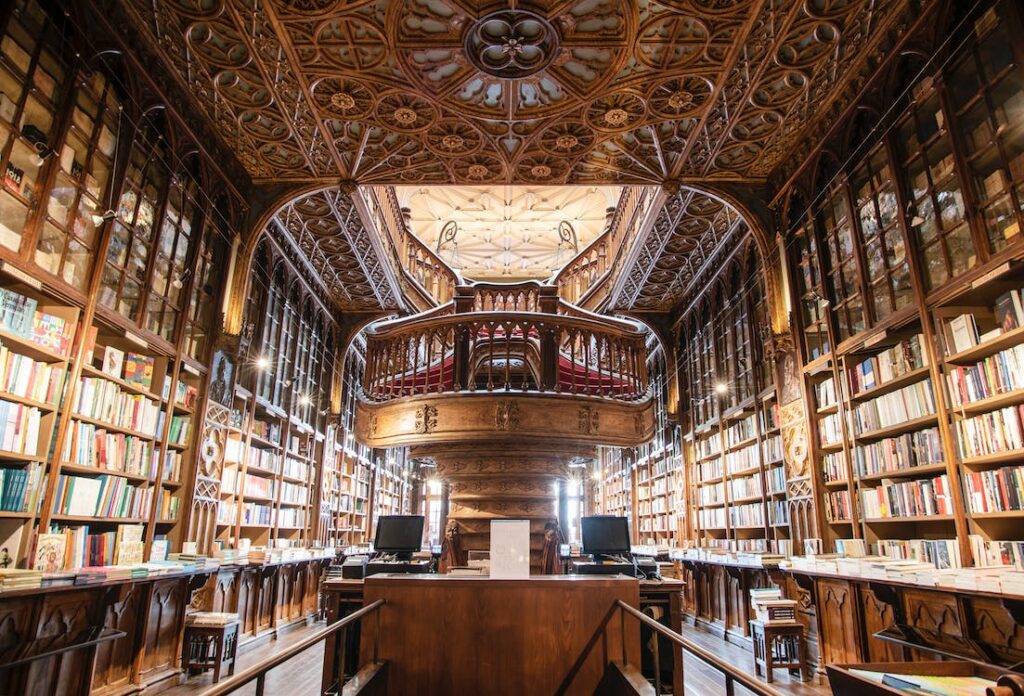

Rare Books – A Page-Turning Investment

Although buying books may seem like an odd investment, doing so might be a smart move for investors trying to diversify their holdings. Due to the fact that they are a tangible item that is unlikely to lose value, rare books in particular might make excellent investments.

So why should you buy rare books? They have a lengthy history of appreciation, to start. As a matter of fact, rare books have long been a sought-after investment, with some of them bringing in millions of dollars at auction.

In addition, compared to other investment options, the market for rare books is often stable. While the stock market might be unpredictable, a rare book’s value is less likely to change drastically over a short period of time.

But how do you begin investing in rare books? You should first become familiar with the market. Attending book fairs, reading books about rare books, or making connections with other book collectors are all effective ways to do this.

It’s time to start looking for your new investment once you’ve done your study. The following things should be considered when looking for a rare book:

- Condition: In general, a book in good condition is worth more than one that has been damaged.

- Rarity: Similar to classic cars, rarity makes a book more expensive.

Conclusion

Vintage vehicles and rare books are two examples of alternative investments that can add variety to your portfolio. They offer the chance for significant rewards even if they have their own set of difficulties and dangers.

It’s crucial to do your homework and comprehend the market before buying in antique automobiles or rare books.

Vintage vehicles and rare books both present a singular opportunity for those who are willing to think outside the box, whether you’re wanting to invest in a physical asset with historical significance or a work of art that can increase in value over time.

So why not branch out and add some excitement to your financial portfolio by purchasing a vintage car or rare book? Who knows, you might just get lucky and win big!

Finally, keep in mind to never invest more money than you can afford to lose without first speaking with a financial expert. Invest wisely!

ALSO READ: The Long-Term Financial Effects of Not Paying Off Student Loans

This is Dean and he is a former banker with a passion for writing. He has Bachelor’s degree in Economics and an FCE English level certificate. Dean is an honest person looking for long-term partners and always giving clients more than they expect.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

What are the Best Options for Investing in the Circular Economy

-

What are the Best Strategies for Investing in Infrastructure Debt

-

Squirrel vs. Moneybox: A Comparison of Savings and Investment Apps

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important