Personal Finance

Squirrel vs. Moneybox: A Comparison of Savings and Investment Apps

Squirrel vs. Moneybox: A battle of the brawny and the brainy.

Published

3 years agoon

It all boils down to selecting the ideal software for your needs when it comes to saving and investing. Since there isn’t a single, effective answer, we tested two well-known apps.

We have the strong and brave Squirrel in this corner.

The logical and analytical Moneybox is in the other corner. Let’s find out who succeeds!

The Contenders: Squirrel and Moneybox

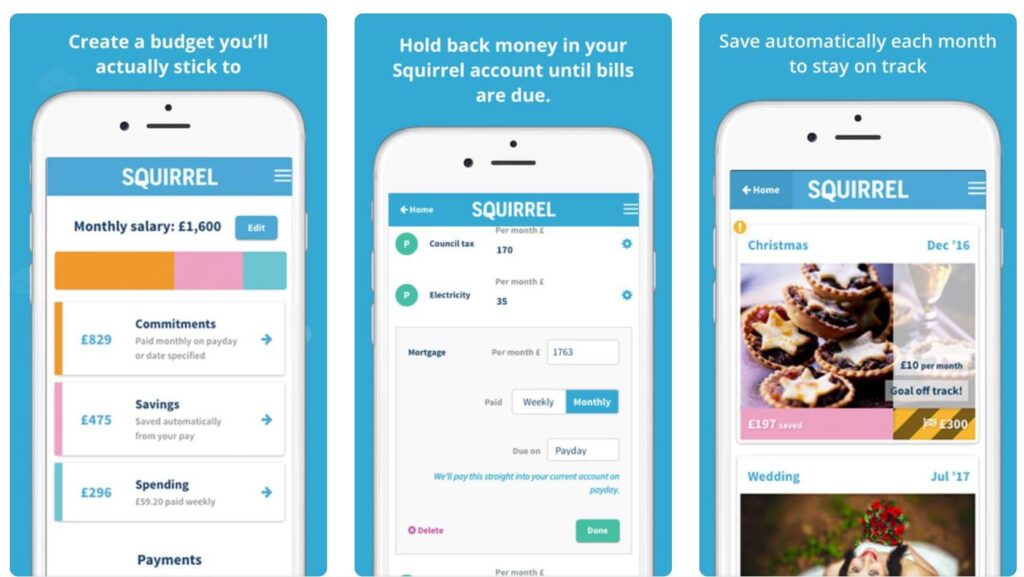

A smartphone application called Squirrel invests the spare change after rounding up your purchases to the next pound. It’s a straightforward and user-friendly solution for individuals who wish to begin investing without having to put too much thought into it.

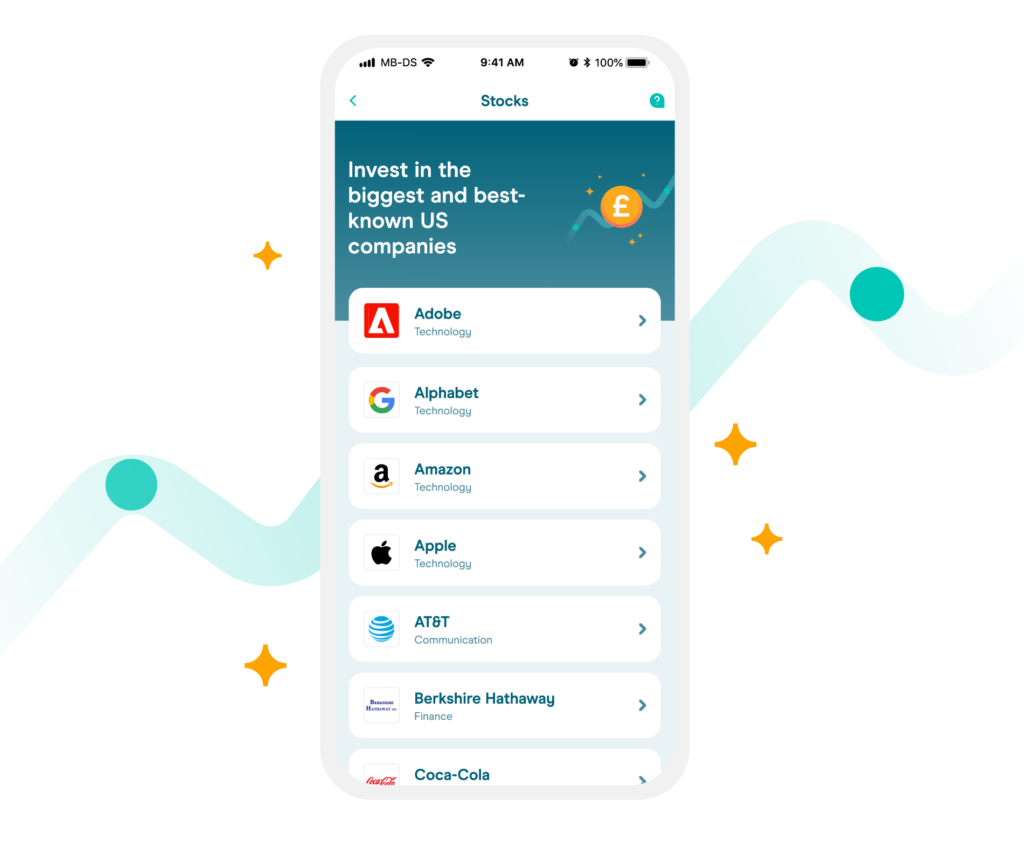

The full-featured financial software Moneybox, on the other hand, offers a variety of investment alternatives as well as the opportunity to set and monitor savings goals. It’s ideal for people who want to approach their assets more actively.

Round 1: Ease of Use

Squirrel leads the pack in terms of usability because of its straightforward round-up feature. You may link your bank account and begin investing your spare cash with only a few taps.

A little more time and effort are needed to set up your investment goals and select the appropriate investment products with Moneybox, which is a little more complicated. But once you figure it out, it’s worthwhile!

Round 2: Investment Options

Clearly, Moneybox prevails in this contest. Moneybox offers a variety of investment options, including ISAs, pensions, and ETFs, whereas Squirrel only offers one investment option. As a result, you can diversify your investments and pick the best solutions to meet your financial objectives.

Round 3: Fees

When it comes to fees, Squirrel is the undisputed champion. For individuals just starting out with investing, it’s a cost-effective choice as there are no account minimums and no management fees.

In contrast, Moneybox levies an annual fee of 0.45%, which over time can mount up, particularly for larger investments.

Round 4: Customer Support

Squirrel and Moneybox both provide numerous options for customer help, including email assistance and in-app chat. Moneybox has the advantage in this comparison, though, as they also offer a thorough FAQ section and the option to book a conversation with a financial counselor.

Round 5: Security

Security is a top priority for both Squirrel and Moneybox, which use safe encryption to safeguard your personal and financial data. Moneybox, however, has a tiny advantage in terms of the security of your money because they are FCA regulated.

Round 6: User Experience

Squirrel stands out when it comes to user experience thanks to its clear and uncomplicated layout, which makes it simple for customers to comprehend their investments and track their progress.

Although Moneybox offers a user-friendly layout as well, with additional features and settings, some users may find it a bit overwhelming.

Round 7: Integration with Banks

Squirrel and Moneybox both make it simple to integrate with banks, enabling smooth transactions and round-ups. Moneybox is available to consumers in the UK, the US, and Europe, whereas Squirrel is currently only available to UK users.

The Final Verdict: Squirrel vs. Moneybox

Who wins the contest between the squirrel and the moneybox when all things are equal?

In the end, both apps offer advantages and disadvantages, and the best option for you will depend on your specific requirements and objectives.

Due to its minimal fees and simplicity of use, Squirrel is a fantastic option for folks who are just getting started with investing. But Moneybox is unquestionably the winner for individuals seeking additional investment options and the capacity to manage their money more actively.

Whichever program you decide to use, the most essential thing is to start saving money and creating a stable financial future for yourself. Don’t put off managing your funds any longer; download Squirrel or Moneybox right away!

ALSO READ: You Need a Budget (YNAB) vs. Tiller: A Comparison of Budgeting Software

This is Dean and he is a former banker with a passion for writing. He has Bachelor’s degree in Economics and an FCE English level certificate. Dean is an honest person looking for long-term partners and always giving clients more than they expect.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

What are the Best Options for Investing in the Circular Economy

-

What are the Best Strategies for Investing in Infrastructure Debt

-

What are the Risks and Returns of Investing in Frontier Markets ETFs

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important