Investing

Where to Invest if You Want to Retire Early

Learn how to retire early and live a life in luxury in retirement.

Published

2 years agoon

Let’s face it, who doesn’t want to retire early and lead a luxurious life?

Early retirement is becoming more and more common, and the traditional retirement age is gradually disappearing.

But how do you actually realize this dream? Investing is crucial, and we can show you where to invest your money to achieve your early retirement goals.

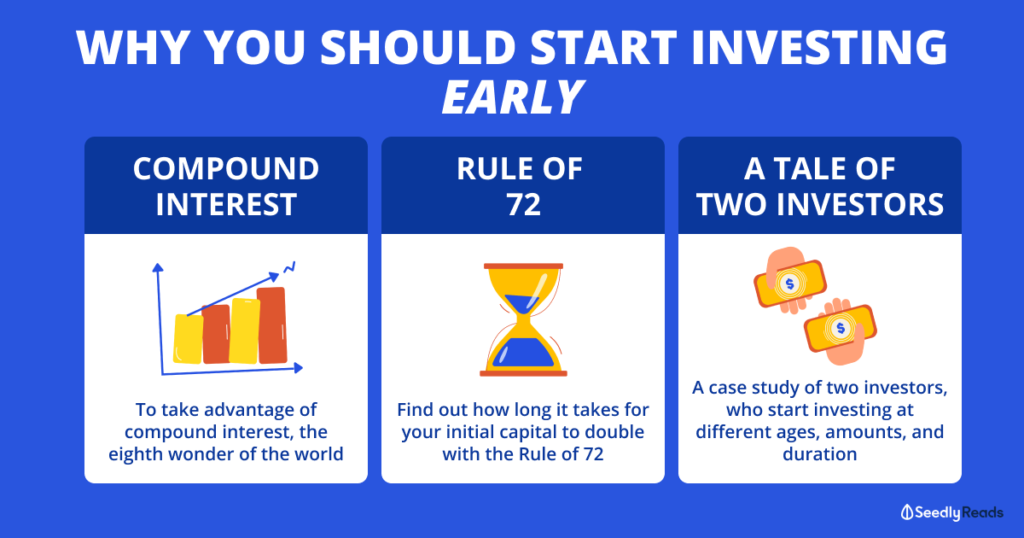

Start Early, Start Smart: The Power of Compound Interest

Your money will have more time to grow if you start investing early. The interest you make in your investments rises, grows, and grows because to compound interest’s magical properties.

The returns increase in size the longer you allow your money to grow. So get started investing as soon as you can, even if it’s just a little bit each month.

Real Estate: The Slow and Steady Winner

For many years, real estate has proven to be a reliable investment, and for good reason. A consistent passive income stream from renting out property is possible, and as property values increase, so does your net worth.

Real estate investing can take time to pay off, but it is ultimately worthwhile. Do your research and only invest in homes that are most likely to increase in value.

Stock Market: High Risk, High Reward

Although it can be a wild ride, investing in stocks can also be quite lucrative. Stocks can be a fantastic way to increase your wealth if you have a long-term investment time horizon and are prepared to withstand market ups and downs.

Just keep in mind not to place all of your eggs in one basket. Spreading your investments over a variety of stocks and industries is important for diversification.

Online Businesses: The Entrepreneur’s Dream

Building wealth and achieving financial independence can be done in large part by starting an online business. There are endless ways to establish passive income streams and grow a prosperous business thanks to the power of the internet.

Also, there has never been a better time to launch an online business, whether through e-commerce, digital marketing, or affiliate marketing.

Bonds: A Safe Haven for Your Retirement Funds

For individuals looking for a more reliable and secure investment for their retirement funds, bonds are a fantastic choice. You are essentially lending money to a business or the government when you invest in bonds in exchange for recurrent interest payments.

This safe investment is a fantastic method to even out your portfolio and guarantee that you will have a reliable income stream in retirement. Invest in a variety of short-term and long-term bonds to diversify your bond portfolio.

Invest in Yourself: Building Skills and Knowledge for a Better Future

One of the best investments you’ll ever make is in yourself.

Learning new things, expanding your knowledge base, and enhancing your personal brand can have a significant positive impact on your job and financial assets.

You may boost your earning potential and position yourself for long-term financial success by enrolling in courses, reading books, going to conferences, and networking with others in your sector. So, continue to study and constantly make an investment in yourself.

Conclusion

Many of us can realize the ideal of retiring early, but it requires careful preparation and wise investing. There are numerous ways to increase your wealth and gain financial independence, including bonds, equities, real estate, and investing in yourself.

With the correct investments, you may turn your dream of retiring early into a reality. But it’s crucial to keep in mind that investing requires patience and time.

To make sure you’re on the proper path, don’t be afraid to conduct your homework, diversify your portfolio, and seek professional counsel. You might anticipate a life of leisure, travel, and financial freedom with the correct plan in place.

Therefore, start early, start wisely, and retire wealthy!

ALSO READ: How to Save Money on Your Next Home Security System

This is Dean and he is a former banker with a passion for writing. He has Bachelor’s degree in Economics and an FCE English level certificate. Dean is an honest person looking for long-term partners and always giving clients more than they expect.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

What are the Best Options for Investing in the Circular Economy

-

What are the Best Strategies for Investing in Infrastructure Debt

-

Squirrel vs. Moneybox: A Comparison of Savings and Investment Apps

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important