Business

How To Make $100 A Month From Dividends | Beginner’s Guide

So, you want to make some extra money? Dividends can be a great way to do that.

Published

3 years agoon

In this article, we’re going to show you how to make an extra $100 a month from dividends. It’s not hard to do, but there are a few things you need to know. We’ll walk you through the basics and teach you everything you need to get started. Follow our guide, and you’ll be on your way to making some extra cash.

What Are Dividends? – Making $100 A Month Easily

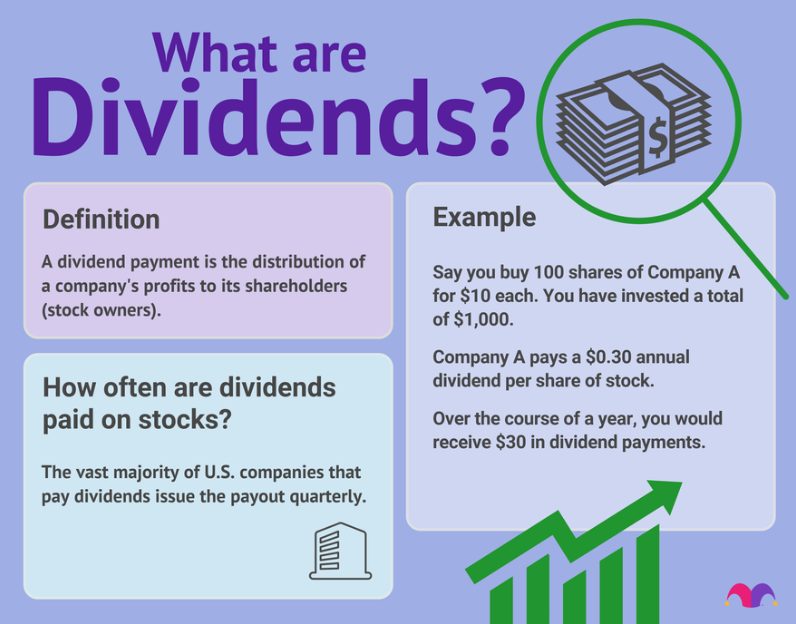

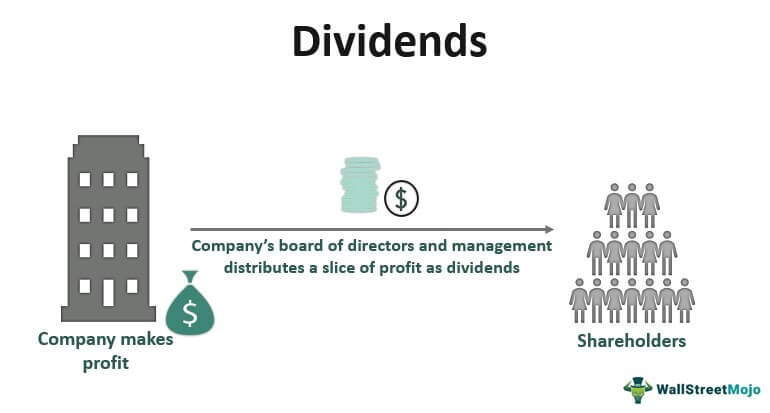

When you invest in a company, you’re not just buying a piece of paper. You’re buying a share of the business, and that entitles you to a slice of the profits.

One way a company can distribute those profits is through dividends. A dividend is a payment made to shareholders out of the company’s earnings.

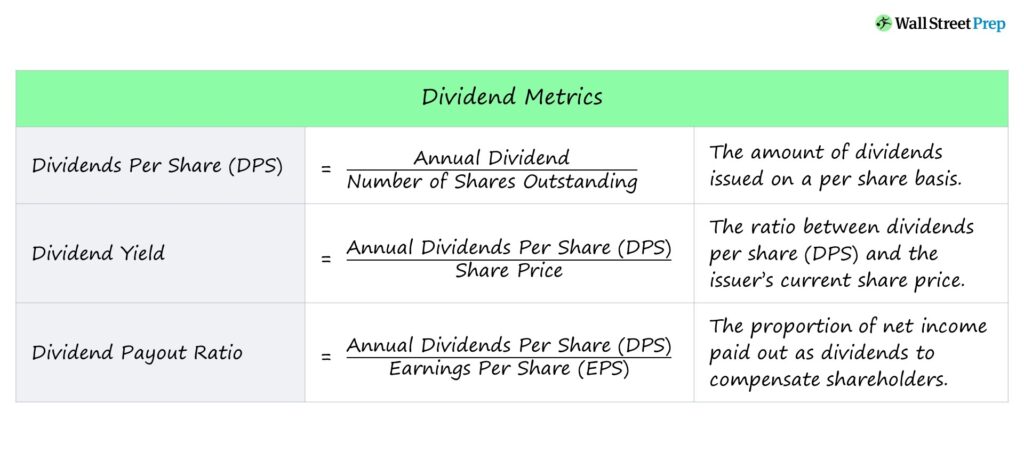

Not all companies pay dividends, but many do. And those that do usually offer a healthy yield. Yield is simply the percentage of the share price that’s paid out as dividends each year.

Dividends can be paid out in cash or in shares. If you’re lucky enough to own shares that are paying generous dividends, you can use that income to help supplement your regular income.

RELATED: How To Invest $150 | Beginner’s Guide

How Do I Make Money From Dividends?

You want to make money from dividends? It is actually not that hard.

All you need to do is buy stocks from companies that offer a solid dividend yield. And then, each month, you will get paid a portion of that company’s profits as a dividend payment.

It’s a great way to make a little extra cash each month, and it’s really not as risky as you might think. In fact, over the long haul, dividend-paying stocks have historically outperformed the broader market.

What Stocks Pay Dividends?

Not all stocks pay dividends. In fact, only about 3,000 of the more than 8,000 stocks on the market pay dividends.

But that doesn’t mean you can’t find good dividend stocks. In fact, there are plenty of high-quality dividend stocks to choose from. You just need to do your homework and make sure the company is healthy and has a track record of paying dividends.

You can also find lists of dividend stocks online, or you can ask your broker for recommendations. Just make sure you do your due diligence before investing in any stock.

How Much Money Can I Make From Dividends?

You may be wondering how much money you can make from dividends. The answer: it depends.

It depends on how much money you have to invest, and also on the dividend yield of the stock you choose. A higher yield means a higher payout, and that’s something you’ll want to keep in mind when you’re choosing a dividend stock.

Another thing to keep in mind is how long you’re willing to wait for your money to grow. Remember, dividends are a form of passive income, so you won’t see results overnight. But if you’re patient and invest wisely, you can easily make an extra $100 or more each month from dividends.

How to Reinvest Dividends

When you receive dividends from your investments, you have two choices: you can either spend them or reinvest them. If you choose to reinvest them, you’ll want to do so in a way that will help your portfolio grow.

There are a few ways to do this. You can buy more shares of the same stock, which will give you more exposure to that company and its performance. You can also invest in other stocks, which will give you a broader diversification in your portfolio.

Another option is to invest in funds or ETFs. Funds are collections of stocks or other securities, and ETFs are funds that track an index, such as the S&P 500. By investing in funds or ETFs, you’ll get instant diversification across a number of different companies and industries.

Dividend Payment Dates

When you’re investing in dividend-paying stocks, it’s important to know when the payments are made. That way, you can plan for them.

Generally, dividends are paid out twice a year—in the spring and the fall. But that can vary depending on the company. So be sure to check the calendar to see when your dividends are scheduled.

If you’re reinvesting your dividends, then you’ll want to keep an eye on the payout dates too. That’s because the reinvestment will happen on the same day as the original payment. So if your dividend is paid out on May 15th, for example, the reinvestment will take place on May 15th as well.

Taxes on Dividends

When you receive dividends, you’re technically receiving a portion of the company’s profits. And as such, you have to pay taxes on that money.

The good news is that the IRS offers a sweet tax break for dividends called the qualified dividend income deduction. What this means is that you can reduce your taxable income by up to $40,000 ($80,000 if you’re married and file jointly).

There are a few things to keep in mind when it comes to taxes and dividends:

– You must own the stock for at least 61 days during the 121-day period that begins 60 days before the ex-dividend date.

– The dividend must be paid by a U.S. company or a qualified foreign corporation.

– You must report the dividends on your tax return.

Final Note

You’ve decided that you want to make money from dividends. Good for you! This guide will teach you the basics of how to make $100 a month in dividend income.

You will just need to open a brokerage account and purchase some shares of dividend-paying stocks. Next, you will need to find a way to reinvest your dividends so that your money can work for you even while you’re asleep.

Finally, you’ll need to track your progress and make course corrections as necessary in order to continue generating dividend income month after month. Enjoy making extra cash with dividends!

Ansherina is an Asian student majoring in political economy. She is an ambitious person who isn't afraid of adversity. She enjoys a wide variety of article writing. She cares deeply about her work and is competent in her field.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How Do I Request a Business Audit

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

Starting a Dog Boarding Business at Home and the Cost Included

-

Why Data Analysis is Important in Making Business Decisions

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important