Investing

What Are the Best Options for Investing in Farmland

This is the perfect guide for farmland investors.

Published

2 years agoon

The days of investing in farming as placing all your eggs in one basket and having them crushed by bad weather and market changes are long gone.

Today, purchasing farmland may diversify your portfolio while producing substantial returns.

But where do you even start with so many possibilities out there? Worry not, as we’ll help you learn about the best opportunities for purchasing farms.

Direct Investment in Farmland

Let’s begin with the traditional choice: direct investment in agricultural land.

This entails purchasing a piece of land and either operating the farm yourself or leasing it to a farmer.

Despite the possibility of huge returns, it’s necessary to consider the sizeable initial outlays, ongoing costs, and risk of erratic weather and market circumstances.

Direct investment in farms, however, may be a profitable and enjoyable experience for people who have a passion for agriculture and are ready to put in the work.

Just be sure to conduct thorough research and comprehend the local industry and laws before making any significant choices.

Farmland Investment Funds

Don’t worry if the thought of getting your hands dirty doesn’t appeal to you. Farmland investment funds give investors the chance to purchase a variety of farms without having to deal with running them on a daily basis.

These funds often invest in a range of farmland in many countries, giving them exposure to various markets and lowering the risk that your earnings may be negatively impacted by a single poor harvest or market shift.

Before anything else, make sure to read the fine print before investing your hard-earned money.

However, do keep in mind that these funds frequently have hefty minimum investments and management costs.

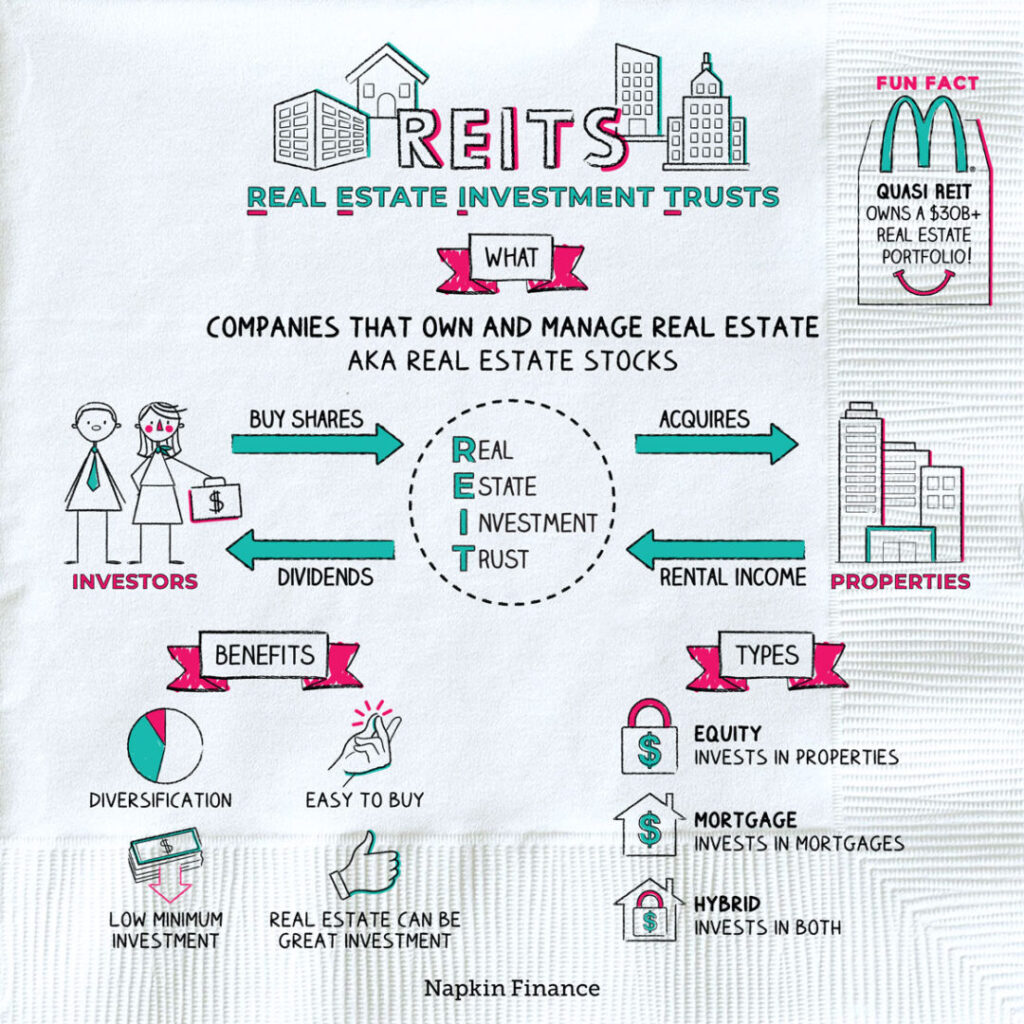

Real Estate Investment Trusts (REITs)

For individuals wishing to invest in farms without the inconvenience of direct ownership, real estate investment trusts, or REITs, provide an additional choice.

Listed on stock markets, REITs invest in a range of real estate assets, including farmland.

This choice has the benefit of liquidity and ease of diversification because REIT shares can be bought and sold just like any other investment.

It’s crucial to keep in mind that returns can be lower than those from a direct investment in farmland because a portion of your profits will be used to cover management costs and other costs of running a publicly traded company.

Factors to Consider

Whatever route you take, there are a number of things to think about before buying farmland.

First and foremost, it’s important to learn the local market and laws as they have a significant impact on the worth of your investment.

The prospective profits on your investment will also be influenced by other elements like the condition of the soil, the availability of water, and market demand for the crops that are grown on the property.

It’s crucial to take your investing horizon’s length into account.

Farmland can be a long-term investment because it might take some time for the land’s worth to increase.

As a result, you need to have a well-diversified portfolio and a thorough grasp of the risks involved.

The Importance of Due Diligence

Doing your homework is essential for a successful agricultural investment.

This entails studying the local market, comprehending the rules and legislation governing the ownership of farmland, and weighing the rewards and risks of various investment opportunities.

To ensure you completely comprehend the complexity involved in investing in farmland, it’s also crucial to deal with reputable professionals, such as a real estate agent with experience in farmland investments, a financial advisor, or an attorney.

Don’t hesitate to investigate your options and ask questions because a wise investment choice can mean the difference between failure and success for your agricultural investment.

Conclusion

Farmland investments can provide significant returns and portfolio diversification, but before making any choices, it’s crucial to think about your investment objectives and risk tolerance.

There is a farmland investment opportunity out there for everyone, whether you want to be a hands-on farmer or a hands-off investor.

Just keep in mind that investing in dirt isn’t for the faint of heart, but the benefits can be plenty for those willing to do their due diligence and endure the ups and downs. Happy gardening!

ALSO READ: How Much Money Can You Make From Starting a Personal Finance Blog

This is Dean and he is a former banker with a passion for writing. He has Bachelor’s degree in Economics and an FCE English level certificate. Dean is an honest person looking for long-term partners and always giving clients more than they expect.

You may like

-

How to Find the Best Green Technology Start-Ups to Invest In

-

How to Maximize Returns by Investing in Private REITs

-

How to Invest in the Future of Transportation Such as Autonomous Cars and Drones

-

What are the Best Options for Investing in the Circular Economy

-

What are the Best Strategies for Investing in Infrastructure Debt

-

Squirrel vs. Moneybox: A Comparison of Savings and Investment Apps

Best Problem-Solving Strategies In Business

How to Start Affiliate Marketing Through Amazon

How to Plan A Wedding On A Budget

10 Reasons Why Budgeting Is Important